No matter how big or successful a business is, maintaining a healthy level of cash flow is key.

By Edward Wade

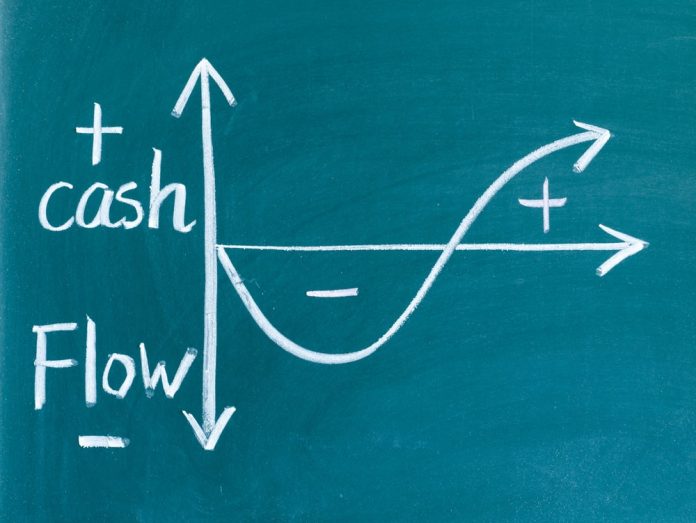

Simply, cash is key and the lifeline of any business. It doesn’t matter how good your sales and profits are, if there isn’t enough cash to pay outgoing costs when they’re due the business will inevitably fail. One bad debt, or a few bad months could set the business towards a negative spiral of being constantly behind. There are things which can be done to help a company prepare for cash flow issues and tackle the problems as they hit the business.

Identifying the common causes of cash flow troubles

For the majority of businesses and especially start-ups it’s just down to timing. It normally comes down to late paying clients, which leads to owners being left shorthanded and then how quickly a business is able to pay its dues. Even if a business is making lots of sales, if that money doesn’t come in quickly enough a business will struggle.

Cash flow issues will sometimes occur through no fault of the business. Even if things are running smoothly, a piece of machinery could break or the marketplace could be become inflated. These unexpected costs could swerve a business off track as they have to compensate these large costs.

Perhaps the most common cause of cashflow issues comes down to a lack of planning ahead. A cashflow forecast needs to be created with all the incomings and outgoings included as part of the preparation for the business. All start-up costs and the potential long-term effects this can have on cash flow need to be considered. How long will it take the business to cover those initial investments? If a business relies on certain seasons, then seasonal variations must be considered, will the business have enough money to survive the remaining months?

How can the business be more efficient with incomings and outgoings?

As well as continuous planning there are techniques businesses can put into place to help maintain a flow of cash and shore up incomings and outgoings. The idea of controlling the flow of money coming in and out of a business might seem like an easy prospect, however, in reality it’s not always that easy.

- Be assertive with clients and if needs be, follow up on late paying clients

- Carry our credit checks on your clients and assess their history

- Make it the business norm to collect up front deposit payments from clients

- Make use of outgoing repayment terms. It might mean paying on the last day of a contract

- If the business deals with regular suppliers but the business is struggling with cash flow, talk to them and try to arrange payment at a later date.

Having clients that pay on time, is what every business need and want, but ensuring it happens can be extremely difficult. Clients are often unreliable, so it’s important for a business to stay on top of them and try to ensure they get their money within a reasonable time frame. If a client hasn’t paid within their terms, follow it up immediately. It might only be an email or phone call, but if you push them quickly, a business will be more likely to receive payment, there is nothing wrong with a business pushing for what it’s owed. This is especially important if a business is relying on one client, or just a few.

Bringing in some money, is better than not. This is why asking clients for a deposit can be hugely beneficial. The quicker money can come into the business, the easier it is to make outgoing payments. Although clients might be hesitant at first to make a down payment, it would actually break up their payment and could make it easier for them to complete payment.

For your own outgoing payments, it’s important to be savvy when it comes to a business spending its own money. Take full advantage of repayment terms, if you have the option to pay within 30 days and it will ease cashflow troubles to pay on the 30th day, then it’s important for businesses to use this option. When it comes to paying overheads, try to make them run parallel with when the business receives regular client payments.

If the business is in trouble, what can I do?

If a business is already having cash flow problems, sometimes it can make seem almost impossible to get out of trouble. However, there are solutions available, depending on the reasons being behind cashflow issues.

For B2B businesses invoice financing can be a brilliant option to steady the ship and bring in some much-needed cash. If late paying clients are the main problem, invoice financing effectively allows the business to obtain an advance, based upon the value of your invoices from those clients.

A factoring company assess the quality of the businesses invoices as well as any potential risk involved. If everything is deemed ok, the factoring company, would advance you a percentage value of the invoice, before collecting it from the client, taking back what they are owed along with a fee and then giving the change to the business. Not only does this give you the necessary cash to help with any problems, it also frees up more time, so there aren’t people chasing up clients.

If the business has been hit by a large bill they perhaps weren’t expecting, then a business overdraft may be a better route to go down. This means that a business can have funds available, once their account becomes overdrawn. The amount available is agreed with the bank beforehand and will be created to meet the needs of the business. If the problem is only temporary, then a modest amount of cash will be available in the overdraft facility, if there is a larger amount needed for a longer period of time, security will likely be required.

Bank loans are another solution, however, these are normally last case scenario. A bank would be hesitant to loan to a business which is having cash flow trouble, as it may suggest that the business simply doesn’t work. If a business could prove that the model is viable and they’ve simply had bad luck, then sometimes banks would be willing to loan.

Edward Wade is a journalism graduate from Sheffield and a writer for Wilson Field, a financial solutions services. He is an avid business writer who focuses on advice for start-ups and SMEs.

Cash flow stock image by Perfect Gui/Shutterstock