14 Things Entrepreneurs Need to Know

By Rieva Lesonsky

The Year Ahead: Check out the first four posts which focus on 2016.

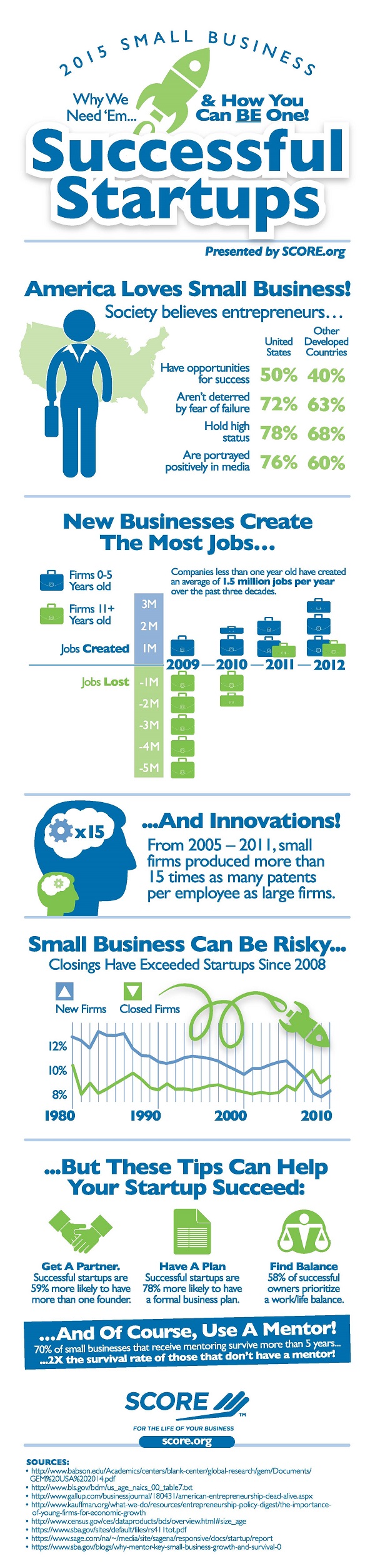

1) How to Be a Successful Startup

The beginning of the year is a popular time for many to make resolutions about starting a business. If you’re one of those, SCORE has curated some info about how small businesses can thrive.

Not surprisingly Americans have a more positive view of entrepreneurs than people in other countries:

- 50% of Americans believe entrepreneurs have opportunities for success vs. 40% of residents in other developed countries

- 78% of Americans believe entrepreneurs hold a high status vs. 68% of residents in other developed countries

- 72% of Americans believe entrepreneurs aren’t deterred by a fear of failure vs. 63% of residents in other developed countries

There’s good news for startups too. Young businesses (less than one year old) have created an average of 1.5 million jobs per year for the past three decades. Between 2005 and 2011, small firms produced 15 times as many patents per employee as large ones.

Successful startups share some characteristics:

- 59% are more likely to have more than one founder

- 78% are more likely to have a formal business plan

- 70% of small businesses that receive mentoring survive more than five years—twice the survival rate of those who don’t receive mentoring

Download this month’s SCORE Infographic for more information on successful startups.

2) Where the Startups Are

Speaking of startups, the folks at NerdWallet recently published a report featuring the best cities for young entrepreneurs to launch in. The awesome city of Austin, Texas, came in first.

After studying 181 metro areas in the U.S., NerdWallet found the top 5 states for small-business financing are:

- Utah

- California

- Colorado

- Georgia

- Idaho

There’s a lot more info at NerdWallet’s blog.

3) 6 Investments that Can Help Your Business in 2016

IBISWorld Procurement Research Analysts have identified 6 investments that can help businesses improve employee and client relations, cut costs and keep their new year’s resolutions.

The report says, “As technology and the percentage of services conducted online continue to grow, businesses will gain more from investing in software and online programs that can improve the customer experience. CRM software, for example, helps companies organize client information so that they can ensure that customers receive the proper care and attention regarding queries and technical support. On the other hand, businesses can also improve customer relationships by investing in mobile app development, which gives customers easy access to their services. IBISWorld estimates that prices for these services will increase 1.3% and 0.8%, respectively.”

To see the in-depth report, Purchases to Better Plan for the New Year, click here.

4) Small Businesses Feeling Bullish About 2016

Yelp recently released its first-annual Small Business Pulse Survey, showing 85% of the small businesses active on Yelp expect their revenues to grow in 2016, estimating an increase of 26% growth in the year ahead.

This positive outlook was evident throughout the survey. Small restaurants, active on Yelp, were most upbeat about 2016, with 92% expecting an overall revenue increase.

Despite this optimism, there are some concerns. Businesses in the Yelp survey cite developing competitive growth strategies as their greatest challenge. Other top identified issues include attracting and retaining customers (60%), managing a limited marketing budget (32%) and competition from larger businesses (30%).

Many of the business owners attribute at least some of their success to digital marketing, which gives them the tools and confidence to engage with and attract new customers. In fact, 85% of small businesses believe digital marketing has helped their businesses grow their customer base, and 91% use digital marketing tools such as social media platforms (75%), consumer review platforms (48%) and search engine advertising (48%).

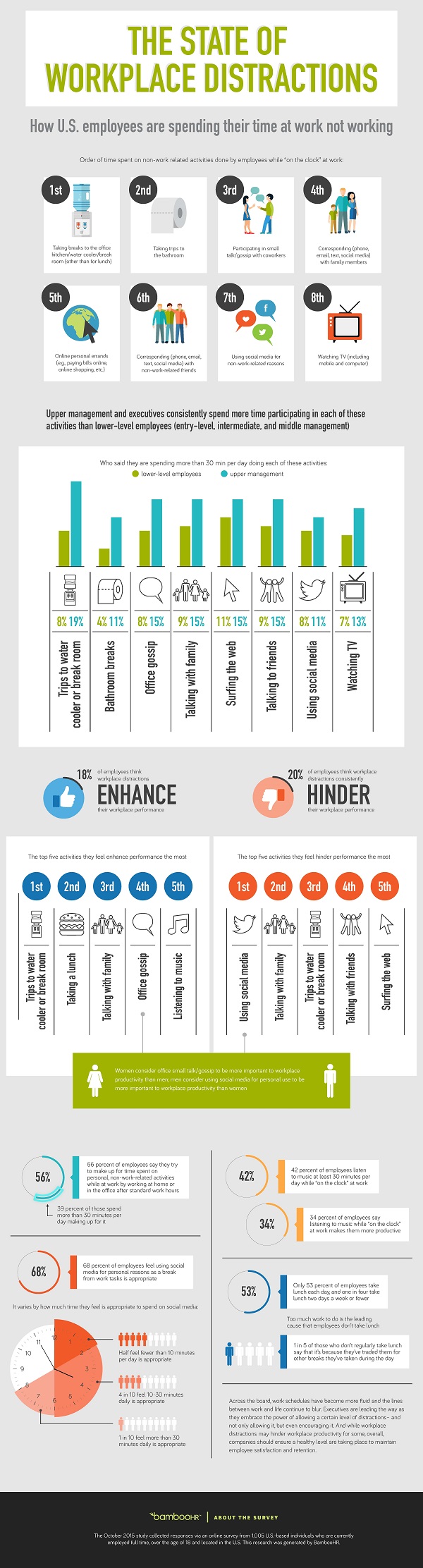

5) Wasting Time

A recent survey from BambooHR shows how employees spend time at work—not working. The study reveals that traditional activities, like taking breaks to the office water cooler/break room and participating in small talk, still reign supreme as the most time-consuming workplace distractions.

Key survey findings include:

- Employees spend more time on traditional distractions (breaks to the office kitchen/water cooler/break room, small talk/gossip with coworkers) than digital (surfing the web, social media, texting)

- Across the board, upper management and executives spend more time participating in these types of activities than lower-level employees

- Women consider office small talk/gossip to be more important to workplace productivity than men; men consider using social media for personal use to be more important to workplace productivity than women

For more information, check out their blog post.

6) 5 Tips for Selecting the Right Business Loan

Guest post by Kathryn Petralia, Kabbage co-founder and COO

As someone who has been involved in seven start-up businesses, I understand the challenges associated with finding business funding.

Since co-founding Kabbage Inc. more than six years ago, I’ve been fortunate to play a role in supporting tens of thousands of entrepreneurs working to sustain and grow their businesses. Traditionally, entrepreneurs have been underserved by a lending process that is too slow, manual, and risk-averse to invest in small businesses.

Small business owners are increasingly seeking reliable sources of funding that match their fast pace and are willing to extend capital to newer ventures that exhibit great potential.

If you are a small business in need of extra capital to take the next step in your business trajectory, here are a few key considerations to keep in mind as you research funding options.

- Review your business finances

Before pursuing any financial options, thoroughly review your records to ensure your business is best positioned for loan approval. Most lenders will require documentation showing a history of strong performance [so they can see there’s] a high likelihood of repayment.

Bookkeeping tools like Sage, Xero and QuickBooks can help you document your income and expenses, providing a detailed review of your business performance.

It’s crucial to separate your personal and business finances to easily illustrate the financial strength of your business. If you have not already done so, open a bank account and credit card under your business’s name.

- Be cautious before borrowing from family and friends

In the early stages of their businesses many entrepreneurs self-fund through personal savings or credit cards, or by accepting capital from family and friends.

Advantages: When looking for business capital, those who know you best are most likely to recognize your talent and passion and support you as you pursue your vision.

Drawbacks: Relying on family and friends gives you a limited pool of funding. Blending business and personal connections requires a delicate balance, given the risks for everyone involved.

Takeaway: While there can be upsides to sharing successes with your friends and family, the risks often outweigh the short-term financial benefits.

- Use credit cards sparingly

Because they provide quick funding and point-of-sale access for a variety of business needs, credit cards are a popular way for entrepreneurs to fund immediate business expenses.

Advantages: Credit cards are easy to access anywhere for any business expense.

Drawbacks: For many business owners, credit lines are too low to make a significant impact on your goals. Further, consumers who utilize more than 50% of their credit lines will see their credit scores drop, which lowers not only the cost of personal borrowing but makes borrowing from a bank or other lender more costly.

Takeaway: Credit cards are a reliable cash management tool and can be advantageous during early growth stages, but they can limit large and long-term growth plans.

- Don’t rely only on a bank loan

In the past, the only option for small business funding required small business owners to visit a bank, which demanded extensive paperwork and significant time investments.

Advantages: If you can get a small business loan from a bank, you’ll typically pay lower interest than most other options.

Drawbacks: Banks make their greatest margins by lending larger sums than most small businesses seek. As a result, entrepreneurs often do not feel like a priority for many big banks. Banks’ extended review timelines and documentation requirements, which lead to a decline more than half the time, do not work for small businesses that need to invest that time in their businesses.

Takeaway: If your business is newer and does not have an established track record of strong performance, you may want to look outside of traditional bank loans for small business funding.

- Consider online lenders

With the rise of entrepreneurs searching for funding that fits the modern age, new, technology-enabled lenders have emerged, offering greater flexibility and speed than many traditional funding methods.

Advantages: Tech-enabled lenders won’t require you to compile endless financial records or wait weeks for a decision. Apply online, and you’ll have a decision based on your latest business data, with access to capital in minutes, not weeks.

Drawbacks: Some online loans carry higher interest rates than traditional bank loans.

Takeaway: If your business is not eligible for a traditional loan, innovative companies like Kabbage [and others] are making it possible for small businesses to access the funding they need to keep growing.

7) Time to Grow

How do you know when it’s a good time to grow? Small businesses often strive for growth without evaluating whether the conditions are right in order for them to be successful. And growth under the wrong conditions can lead to huge losses or business failure.

A new paper from Michelle Di Gangi, executive vice president of Small- and Medium-Size Enterprise Banking at Bank of the West, digs into how small businesses—and U.S. manufacturers in particular—can pinpoint the optimal moment to grow strategically and profitably.

Michelle provides a simple framework for smart growth:

Plan: Frequently, growth just happens. Other times it needs serious planning. The manufacturers that are expanding most effectively have a growth plan that defines objectives, provides the strategy and tactics for achieving growth, and identifies the risks. These plans are reviewed and refined quarterly, if not monthly, as goals are met or missed and circumstances change.

Invest: Look for opportunities to invest in the business that will increase profitability over time. According to the 2015 Bank of the West Small Business Growth Survey, small and midsized businesses clearly understand the value of investing in their companies, with three out of four business owners intending to invest in the year ahead.

Investment plans vary from manufacturer to manufacturer, but Bank of the West research and conversations with manufacturers point to a common theme: Investing in technology makes a difference. The Bank of the West Small Business Growth Survey found that growing companies are twice as likely as declining businesses to say investing in technology is extremely or very important to success in the next year. More than half of growing businesses indicate that they have increased their technology budget over the past 12 months.

Fund: Procuring new equipment, investing in the latest technology and purchasing raw materials all require capital investments. Common funding paths—cash flow and credit—have very different implications, and discerning which option is right for your business is critical.

Relying on cash flow saves financing and interest costs and may reduce risk. Relying on profits to grow imposes financial discipline and may help keep a business from expanding too rapidly and becoming over-extended. But, relying on cash flow may also constrain growth and limit a manufacturer’s flexibility in good times and bad. Conventional lines of credit, commercial real estate loans, and Small Business Administration (SBA) loans have helped many manufacturers to expand in economic upturns as well as ride out rough patches or business disruptions.

8) “Not-com” Website Domains

Apparently there’s been some concern in the small business community about the release of hundreds of new “not-com” website domains in the past two+ years. According to the folks at Google, “While these names offer a lot of new web naming possibilities, there have been a number of misconceptions and confusion surrounding these new domain endings.”

At the end of last year, Google Domains confirmed, “without a doubt, that the new “not-com” domains are just as easily found online as their dot-com counterparts. In fact, Google’s algorithm does not distinguish if a word is to the right or left of the dot in a web address. If your domain better describes what your business does, potential customers are more likely to find you.”

Google also shared four easy steps all small business owners should take when they move their sites to a new domain in order to increase its search-ability:

- Prepare the new siteand test it thoroughly.

- Prepare a URL mappingfrom the current URLs to their corresponding new format.

- Start the site moveby configuring the server to redirect from the old URLs to the new ones.

- Monitor the trafficon both the old and new URLs.

Read this short blog post from Google to learn more.

9) Finances and the Cloud

Guest post by Mayda Barsumyan, founder of Business Escalation, Inc.

As companies look to streamline operations, outsourcing financial services is the next logical step to cut costs. There are a number of reasons why businesses are turning to the cloud:

Financial Impact: One of the primary drivers for cloud computing is the ability to pay for what is being used. None of the CFOs I work with want to pay for something that is unnecessary nor do they like being made to pay twice. The cloud positively impacts the balance sheet.

Integration: In the world of mergers and acquisitions, companies have mixed technologies. The cloud provides a common platform for integration to take place across multiple legal entities, transparency and accuracy across infrastructure, easy data management, comprehensive business development, and an enhancement of operational efficiencies.

Investment: CIOs do not have to worry about servers and storage and life expectancy of their technology. They are always working with modern and energy-efficient technology that is able to support the business needs. The cloud gives users confidence that they are staying in front of operational needs.

Flexibility: The cloud allows employees to access corporate data from a variety of devices and various locations (at home, on the road, at a client site, etc.). Cloud services enable client’s IT environment to be flexible and adapt easily to ever changing business needs. For example, a user can quickly update forecast numbers from intelligent market insight and have the flexibility of incorporating external data worldwide.

Security: There are many myths about the cloud security. The reality is that well-managed, well-run cloud providers actually offer a higher level of security than the on-site equipment that most of my clients were using. Cloud providers have expert staff to maintain the environment and specialize in security that guards the information from every angle.

10) Financial help for Minority Business Owners

To help minority-owned small businesses navigate the evolving lending landscape and secure the financing they need to grow, Funding Circle, has partnered with the Minority Business Development Agency (MBDA), a bureau of the U.S. Department of Commerce.

Through the partnership, Funding Circle’s small business experts will deliver a range of original financial education programs to minority business owners through MBDA’s national business center network. The materials will focus on access to alternative capital, business strategy and every business owner’s right to fair and transparent financing, as outlined in the Small Business Borrowers’ Bill of Rights.

Through the Funding Circle marketplace, businesses looking to borrow up to $500,0000 are matched with accredited individual and institutional investors. By bringing together industry leading risk management and cutting edge technology, Funding Circle’s proven marketplace model enables businesses to access affordable term loans with rates as low as 5.49% in less than 10 days, compared to months with a bank.

11) Does Encryption Create a False Sense of Security?

Alertsec, a cloud-based encryption company, recently released the findings of its Alertsec SMB 2015 Encryption Study. The Study reveals that businesses overwhelmingly fear that standard security precautions create a false sense of security for laptop and mobile users. For example, 68% of SMB executives believe auto-saved passwords are not secure, 48% believe never logging out of user profiles decreases security as does having 4-6 digital passcodes (45%). In addition, 23% believe lock down (when functionality of the system is restricted) is not secure, while 16% believe that lock ups (when multiple password attempts failed, causing restrictions) are also insecure.

“The real problem is the false sense of security these ‘security precautions’ create,” says Ebba Blitz, President of Alertsec. “Computer manufacturers and software vendors offer a variety of built-in solutions that seem to protect you, but they are no match for the run-of-the-mill cybercriminal. That’s why encryption is so important. Losing data could cause a problem of catastrophic proportions for any individual and any company.”

The study also shows 87% fear data breaches. Specifically their concerns are:

- 40% fear leaving their laptops in the car and then having their identity stolen

- 37% are afraid their laptops will be stolen while they’re working at a coffee shop

- 30% fear burglars breaking into their homes and obtaining online banking information

- 27% fear having their laptop stolen at airport security and having their Dropbox and photo files breached

Because of the problems they’ve seen at work, 68% of the SMB executives have encrypted their personal computers, because they fear their financial files will be compromised (39%). They believe data breaches are both very damaging (35%) and very common (29%), and think once you encrypt your work computer, you have to encrypt everything (16%). Only 3% said they encrypt their PCs because they fear the government is snooping into their files.

Most (90%) say work computers should be encrypted, followed by smartphones (61%), personal computers (58%) and tablets (55%). Only 23% think cars should be encrypted, but this number will likely rise in the near future with the release of smart, self-driving cars. One-third (32%) of those polled do not encrypt their personal computer.

When asked what benefits of encryption as a service make it indispensable to SMBs, 75% say encryption gives them a peace of mind and report the benefits as:

- No need for IT staff or software, and no impact on the encrypted computer (32%)

- Payment as you go (29%)

- No need for training (25%)

- Eliminates the need to invest in multiple products (23%)

Cool Tools

12) Smart Links Service for App Marketers

Product lab MEA announced late last year its launched Zebroute, a new developer tool that allows app owners to provide users with a single link automatically directing users to the appropriate app store based on their device type, mobile OS, location, language and other information. Zebroute is available as a free service or through a paid premium account with advanced functionality.

Previously, marketers had to provide unique links to each individual app or use a custom configuration–ineffective and costly solutions.

“App developers creating marketing websites and newsletters are now able to eliminate the clutter resulting from multiple links to various apps. These look untidy and risk users clicking the wrong link and becoming disengaged,” says MEA director Bruce Seymour. “Zebroute creates one smart link for users to click, which intuitively knows what device the user is on and what their language and location preferences may be.”

The free service is complimentary to SMS and MMS marketing as well as email marketing through services such as MailChimp, myEmma and Constant Contact.

13) No More Missed Appointments

According to Apptoto, missed appointments cost the economy about $65.7 billion every year. The best way to ensure your clients show up is to send them an SMS message at 6PM the day before their appointments.

Apptoto, a cloud-based, automated appointment messaging service, also reports:

- SMS messages are replied to more often than calls (30% vs. 23%)

- Emails perform the lowest, at a 12% reply rate.

- Sending a text message at 6 AM more than two days before an appointment can lead to a no-show rate of 43%

- An SMS confirmation from a client resulted in only 1.7% rescheduled appointments

14) The Evolution of Payments

According to Currency Cloud, a B2B international payments engine, there are key trends shaping expectations of how money moves around the world, and the technology and infrastructure required to support this change.

Its report, A World Powered by Payments, analyzes how the “Uber economy” impacts the B2B market, and how the increase in cross-border trade strains traditional payment infrastructure typically underpinning the global movement of money. Payments need to be fast. Speed and the need for a seamless process suddenly come into sharp focus, and foreign exchange fluctuation and risk come into play.

Despite the market trends causing shifts in business and payment models, recent research from Currency Cloud shows many American companies lag behind their UK counterparts in the use of technology for international payments. Nearly half (47% of U.S. businesses) still rely on paper checks for international money transfer, with the majority reporting that they are, “unaware of more efficient solutions”. Currency Cloud says, “In a fast-paced, global commercial environment, it is alarming to see continued reliance on a method that adds unnecessary lag time to a transaction and delays subsequent business opportunity. Checks are also expensive. There are overhead costs involved to secure, mail, receive and process checks, let alone the possibility of checks needing to be reissued should they not get cashed on time.”