18 Things Entrepreneurs Need to Know

By Rieva Lesonsky

Happy Holidays! Check out the holiday-related posts #1-#5

1) Small Business’s Thanksgiving was No Turkey

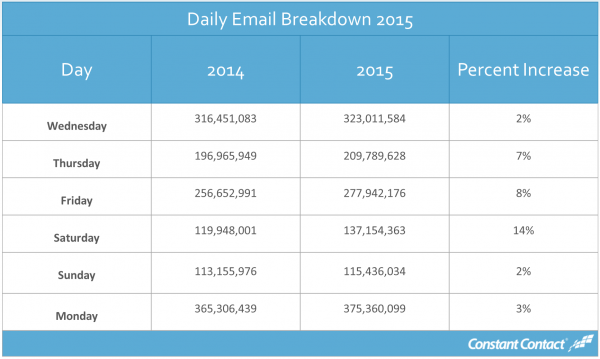

The Thanksgiving weekend numbers are in, and according to Constant Contact, “it appears that 2015 will be known as the year when Small Business Saturday made its mark.” Based on Constant Contact’s email send volume data, small businesses sent 14% more emails this year than last on Small Business Saturday—137,154,363 emails to be exact—the biggest jump in year-over-year volume out of all of the Thanksgiving weekend shopping holidays (Black Friday/Small Business Saturday/Cyber Monday).

What’s more, 2015 Small Business Saturday sales increased…also by 14%.

In fact, Cyber Monday 2015 was the busiest send day in Constant Contact’s history, with customers sending 10 million more emails than last year’s (then record-breaking) number, totaling 375 million emails.

Another interesting mobile trend is evident in the data as well—mobile device opens soared on Thanksgiving Day and Black Friday.

2) It’s in the (Gift) Cards

Although the holidays shopping season is already in full swing, there’s still time for retailers to implement last minute tactics to boost their holiday sales.

Gift cards, both plastic and digital, are powerful tools to incentivize shoppers and ultimately drive revenue. According to First Data’s 2015 Consumer Insights Study, in 2015, 83% of consumers plan to purchase the same amount of or more physical gift cards than last year, while 88% expect to buy the same number of or more e-gift cards.

To help retailers capitalize on this trend now and drive holiday sales, First Data, which owns the digital gift card app Gyft suggests:

- Issuing Small Incentives to Drive ROI: According to the Consumer Insights study, on average consumers shopping with a gift card spend $27 over the amount on the card. Retailers can take advantage of this by delivering a shopping credit via email to encourage shoppers to spend more and halt shopping cart abandonment in its tracks.

- Building Loyalty to Drive Repeat Sales: Loyalty and rewards programs continue to be the top motivator for 55% of consumers to pick up cards for themselves, while 37% are driven by discounts. And as shoppers hunt for holiday sales, 64% report they prefer to receive a gift card more than any other type of incentive and 39% of those report spending more than they planned due to a promotion.

- Expanding e-Gifting Now That It’s Become Mainstream: 50% of consumers are purchasing e-gift cards and more than half are looking to store them on their mobile devices. Millennials are not the only ones purchasing e-gift cards: 42% of respondents over the age of 54 have purchased them.

3) Prepare for Free Shipping Day

Did you know that Free Shipping Day, an online shopping holiday celebrated on December 18 this year, beat Black Friday’s online spending 2 years in a row by more than $250 million?

And all you have to do to participate is offer free shipping and guaranteed delivery by December 24. To help you get the most bang for your buck from this event, Endicia posted a blog highlighting how to prepare for Free Shipping Day. Here are some tips:

- Use social media, email marketing and your blog to let customers know in advance that you’re participating in Free Shipping Day.

- Look at your inventory logs from last holiday season to make sure that you have enough of your most popular items in stock.

- Prepack commonly shipped items to help you get ahead of the rush.

- Consider shipping software to streamline the shipping process.

- Be aware of holiday shipping deadlines.

4) Holiday Stress

According to a new national consumer survey from Needle only 12% of shoppers trust a retailers’ sales associates to assist them in making a gift purchase. And shopper support online is equally bleak, as one in four shoppers have already begun to distrust online product reviews.

The wake-up call for retailers is that gift shopping is the No. 1 cause of holiday stress, outranking time spent with in-laws, travel, and even cooking for picky eaters. That stress is eroding the customer experience, pushing purchases to competitors and eroding customer loyalty.

Needle surveyed consumers about their biggest gift shopping experience pain points. The results show:

- Consumers are plagued with holiday gift giving stress as 84% of consumers state that gift giving causes moderate to high stress.

- Nearly half of respondents plan on purchasing over half of their gifts online this holiday season, 49% in the last 3-4 weeks leading up to Christmas.

- While convenient, shopping online is overwhelming as 60% said that they are unsure of sizing and versions when purchasing a gift and 29% state that there are too many options to choose from.

5) How eCommerce Stores Can Keep Up this Holiday Season

As much as online shopping is growing, most purchases this holiday season will be made in brick-and-mortar stores. So how can ecommerce sites match an in-store shopping experience?

Malcolm Stewart of UserZoom discusses the top 3 struggles ecommerce sites are facing when it comes to online holiday shopping.

Peer Influence & Social Validation

Not only are most sales happening in brick-and-mortar stores, but in general, the average order values are higher and the returns are fewer when purchases happen in person. This is probably because of the peer influence and social validation some experience when friends encourage a purchase.

Audience: Teens and Seniors

Another aspect of in-store shopping success is the benefit of in-store testing and trials. Everyone likes to do this to some degree, but interestingly, two demographic groups in particular display the behavior most.

In an interview at Forbes, Mike Moriarty of the firm A.T Kearney said teens and seniors had a lot in common when it comes to shopping, “Everybody says that teens are online all the time and they do everything online. What the survey found was that teens actually behave a lot like seniors. They actually do a lot more testing and trial in store, a lot more shopping in store, and do a lot of discovery online — much like seniors do.”

Is this phenomenon perhaps due to both groups having more free time to shop than the generations in between? Perhaps shopping is a more social event for teens, and a more enjoyable offline experience for seniors? Whatever the reason, teenagers and senior citizens spend more time considering items in person.

Instant Gratification

Of course, we live in a culture of instant gratification, and nowhere is that more evident than our love of in-store shopping. A survey from Ripen eCommerce showed almost 30% of the shoppers surveyed cite instant gratification as the primary reason for shopping in-store rather than online. The only reason garnering more attention (just over 30%) was seeing and feeling the item in person.

Thus far, online retailers haven’t really been able to replicate the experiences of shopping with peers, handling items before purchase or the all-powerful instant gratification.

6) REPORT ON ONLINE SMALL BUSINESS LENDING

Fundera, the online marketplace for small business loans, recently released its report on the State of Online Small Business Lending. The report was created to help small business owners better understand their loan eligibility by providing data on product trends in the online lending space.

Fundera’s initial report contains data from February 2014 through Q3 2015, and going forward, the company plans to release quarterly report updates in order to track changes in online small business lending and their impact on business owners.

The report includes information on annual percentage rates (APR), loan amounts, time to funding, revenue, and credit profiles by product type. Revealing this data gives small business owners a clear picture of the eligibility requirements for different types of loans, including SBA loans, medium term loans, short -term loans, and lines of credit.

Small business owners in search of capital are often forced to work with predatory lenders and brokers who charge exorbitant fees. As a result, many small business owners end up taking out loans they neither understand nor can reasonably repay.

“While there has been an increase in alternative lending resources, it’s still extremely difficult for small business owners to know who to trust and what to expect,” says Jared Hecht, CEO and co-founder of Fundera. “The purpose of this report is to help business owners make the best financing decisions by offering a resource for true apples-to-apples product and cost comparisons.”

As a co-founding member of the Small Business Borrowers’ Bill of Rights, Fundera has always worked to eliminate predatory lending practices. Fundera’s new quarterly report is another step in the direction of fair, transparent, and accountable capital access for small business owners.

Some key findings:

- Small business owners who obtained short-term financing through Fundera’s lending marketplace report annual percentage rates 15% below available industry averages

- There is strong inverse correlation between credit score and APR.

- There is a strong direct correlation between time to funding and funded loan amounts

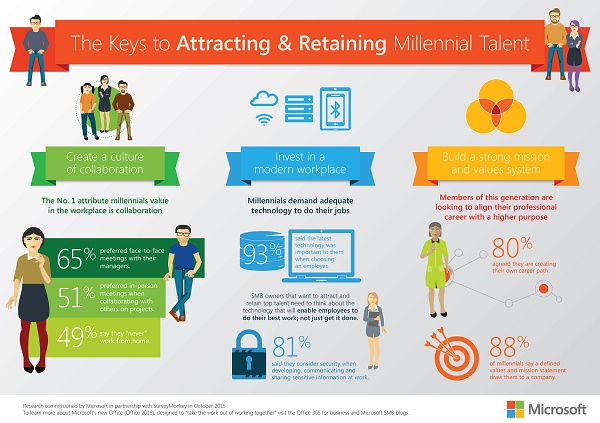

7) The Keys to Attracting and Retaining Millennial Talent

Want to attract Millennials to work for your small business? Microsoft recently revealed new Millennial survey data packed with a lot of information you can act on. Key findings/best practices include:

- 93% of survey respondents say working for a company with updated technology, services and solutions was important to them

- Workplace collaboration is also critical for this group. When asked about the culture of their ideal workplace, 35% say good team collaboration was what they placed the most value on, followed by the ability to grow and create impact (33%), a flexible work environment (24%) and acknowledgement for contributions (8%).

- Challenges still remain when working remotely—33 % say editing or reviewing documents is their top challenge when working from a mobile device, followed by scheduling and viewing calendar invitations (22%) and joining meetings (7%).

- 42% cite connectivity issues as their top challenge, followed by inability to share screens/view information in real-time (23%) and to being able to see participants (17%).

- Security is no joke for Millennials with 81% saying they consider security when developing, communicating and sharing sensitive information at work. When something does go wrong 29% of Millennials solve their tech issues on their own, while 16% ask colleagues for support.

- 58% of Millennials use their own devices to get work done—and 57% say this is important to them.

- 48% use two devices to get their work done, while 23% use three or more

- 80% of Millennials believe they’re in charge and creating their own career paths.

- 31% of employed Millennials plan to stay at their current companies of less than two years, 27% will stay for 2-4 years and 17% will stick with their jobs for 5-9 years

- 88% are drawn to work for a company with a strong mission/values system

- Somewhat surprisingly, 48% of Millennials don’t work from their mobile devices and 49% say they “never” work from home.

8) Why Millennials are Adverse to Sales Jobs and How to Convince Them Otherwise

A guest post by Eliot Burdett, author and CEO of Peak Sales Recruiting

Millennials live in a world that is increasingly virtual. They text, Snapchat, and Tweet instead of picking up the phone and calling one another and Skype instead of going out for coffee. That is part of the reason companies are having a hard time filling a growing number of open sales positions, a profession that requires a great deal of personal, face-to-face connections.

A recent study from Harvard Business School’s U.S. Competitiveness Project found employers spend an average of 41 days trying to fill technical sales jobs versus 33 days for jobs in other professions. The same study cites a cloud-based software company would have had $2 million more in revenue if they met their hiring goals for sales reps. A big reason these jobs have been so hard to fill is because Millennials have not been taking them.

There are a myriad of reasons why it is difficult to get today’s best and brightest into sales. This generation lived through the financial crisis and are the first American generation worse off than their parents. As a result, they have less confidence in the economy and favor stability in their salaries as opposed to the volatility that comes along with sales commissions. They are also known as the trophy generation because they received positive recognition even when they didn’t win and therefore have reservations about a profession that bases your value solely on how many “wins” you have.

The problem for employers is that with 83 million members, Gen Y now makes up the largest sector of the U.S. population and by 2025 will make up 75% of the workforce. The bottom line is that if executives can’t convince these ‘lazy’, tech-savvy, narcissistic, social media ‘brats’ to help sell their products and services, they will not be able to compete in today’s global economy.

Rethink Compensation Packages: Young people want a financial safety net. They favor a higher base pay with a lower proportion of riskier commission pay. The Wall Street Journal cited that the base pay in sales has increased 11.7% from 2010 through 2014 while the variable amount has remained steady. While this demonstrates that the industry is trying to evolve to appeal to Millennials, it is critical for businesses to double down on this and create compensation packages that suit the sales reps of today and tomorrow.

Sales Is Not 9-5, You Can Be Mobile: Being chained to a desk is the worst fear of Millennials. They are inherently global, mobile and social and are always on the go. Sales positions offer the opportunity to wine and dine clients, attend networking events and meet new people. Furthermore, Millennials despise the corporate America practice of sitting around late just to “show face.” Sales is a great profession because those who meet their numbers will rarely, if ever, be questioned about why they aren’t at their desk.

Their Friends Have $1.3 Trillion per Year to Spend: According to The New York Times, Millennials have $1.3 trillion in annual buying power. That means they can easily tap into their vast network to drive sales from day one.

They Like Control, In Sales You Control Your Own Destiny: Based on a poll of 5,800 participants in ten countries, media agency network ZenithOptimedia said global consumers aged 18 to 34 have a “fundamentally different approach” to achieving happiness compared to previous generations. As opposed to the “free spirit” attitudes of the Baby Boomer generation, Millennials seek to gain much more control over their lives to obtain happiness. Therefore, sales represents the perfect profession since it offers reps the ability to control their own destiny, their paycheck and in many cases their hours.

Engage in College Recruiting: Universities are recognizing the viability of careers in sales. In fact, a recent DePaul University survey found that 101 U.S. colleges offered sales curricula in 2011, up from 44 in 2007. With a renewed academic focus on sales, companies now have a real opportunity to work with universities to build a sustainable talent pipeline.

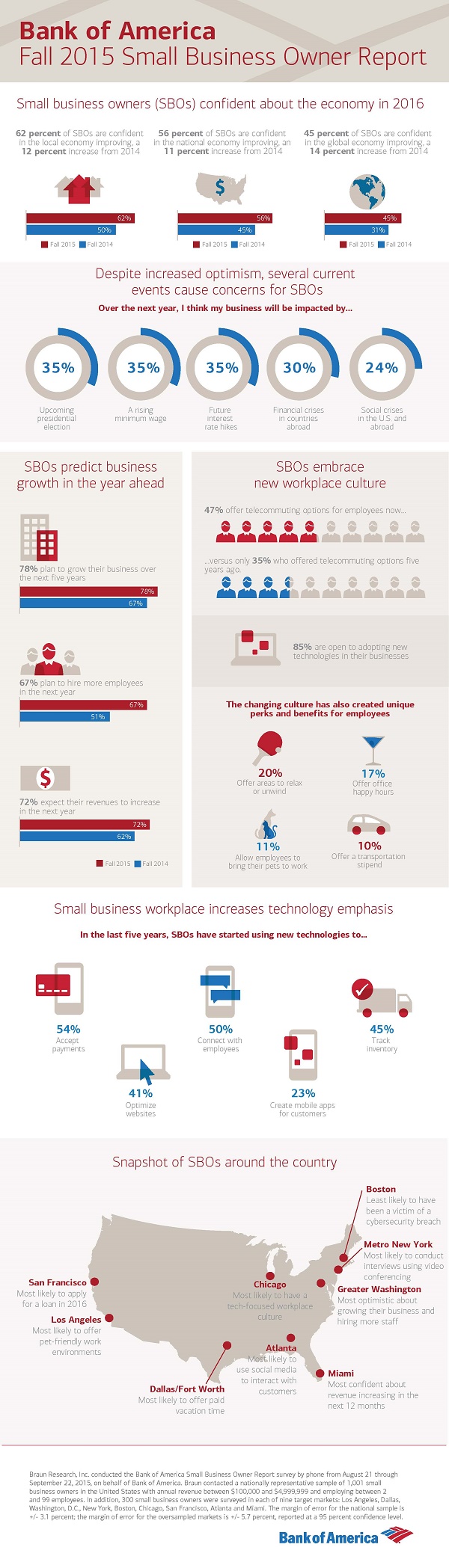

9) Main Street Is Open for Business

America’s small businesses are gearing up for growth. According to the fall 2015 Bank of America Small Business Owner Report, small business optimism is at its highest since the survey’s inception in 2012, with expectations for revenue growth and plans to hire hitting a three-year high.

The report reveals that 72% of small business owners expect their revenues to increase in the next 12 months, compared with 62% a year ago. In addition, more small businesses expect to increase staffing, with 67% planning to hire more employees over the next 12 months, up significantly from 51% in the fall of 2014 and 31% in the fall of 2013.

Confidence in the local, national and global economies rose as well:

- 62% expressed optimism for their local economies

- 56% expressed optimism for the national economy

- 45% expressed optimism for the global economy

Not surprisingly, this expected growth demands more capital—and 35% say they will apply for a loan in 2016. In addition, the number of small business owners who report they have applied for a loan in the past two years has increased by more than 50% in the last 12 months, rising from 29 to 44%.

Working environments are becoming more technology-oriented and flexible. For example, 88% of small businesses say technology is helping them better serve customers, and half have invested in new technology over the past five years to better connect with employees. And 71% report that they are investing in technology upgrades one or more times per year.

Telecommuting is on the rise with 47% of small businesses now offering telecommuting options.. Most small business owners report a positive impact from this shift, including a better attitude in employees (59%) and increased productivity (54%). However, some small business owners expressed concerns that telecommuting makes employees unreliable or inaccessible (34%), or harder to trust (33%).

Employee benefits are also changing, with small businesses taking a page out of the startup book by offering perks like areas to relax or unwind such as nap pods and game rooms (20%), pet-friendly work environments (11%) or onsite gyms and fitness classes (8%).

For a complete, in-depth look at the insights of the nation’s small business owners, read the entire fall 2015 Bank of America Small Business Owner Report. and for additional insights, download the Small Business Owner Report national infographic here.

10) Save Money on Energy Costs

Choose Energy, the leading online marketplace for energy choice, recently expanded its online electricity marketplace for small businesses to Texas. Over the past year, Choose Energy has helped nearly 10,000 small businesses across the country easily and quickly pick an electricity provider online, and in the process, save 30-40% on their electricity costs.

Choose Energy first launched its online small business electricity marketplace in 2014 in New York, Illinois and Pennsylvania. Since that time, it has helped thousands of restaurants, retailers, small offices and other business owners take control of their electricity bills.

Small businesses spend an average of $6,300 each year on electricity. Businesses in 13 states have the opportunity to shop around for electricity and take advantage of lower rates, long-term plans and green energy offered by competitive electricity providers. However, only 50% of all eligible businesses have switched electricity suppliers to date.

“Although buying electricity is not at the top of the list for most busy business owners, electricity bills are not a trivial expense–the majority of small businesses spend at least 10% of their operating costs on electricity,” says Kerry Cooper, Choose Energy CEO. “We hear from our SMB customers that they want to shop for electricity the same way consumers do: online, in minutes, and in their own time.”

By enabling businesses to shop for energy online, Choose Energy has helped to transform what has been a difficult, hands-on process into a simple online transaction. Traditionally, in order to switch electricity providers, businesses were forced to either work with brokers or to wait days from the time they submitted an inquiry to the time they heard back from retail energy providers. Choose Energy’s online marketplace guides small businesses through the electricity choice process and allows them to enroll in a plan online in minutes.

11) 10 Cybersecurity Tips for SMBs

Guest post by Scott Zoldi, FICO

For small businesses, a data breach can be devastating. Global studies estimate about half of companies are out of business within six months of a cyber breach.

The costs aren’t just limited to the immediate theft or data loss that may be monetized by criminals. They costs also include compromise of private company information to customers and vendors, loss of confidential business information, and reputational damage, which all have an impact on future income.

In today’s environment, small businesses are increasingly reliant on third-party services and an ever-increasing array of computing equipment in their operations. Both of which often fall under attack.

Many of us have heard about Sony, Target, and other major breaches because big companies make big headlines, but the majority of breaches happen to small businesses. In fact, more than 80% of breaches are estimated to occur to small businesses, which is troubling because small businesses are often the most vulnerable and the least aware.

How do you secure an organization with limited resources? The first priority is to not be an obvious target—90% of attacks are associated with weaknesses in basic remediation, such as firewalls, passwords, and double authentication. These simple defenses ensure your business isn’t noticeably insecure. I can’t tell you how many times I’ve heard about companies’ security passwords being “password”. A little extra effort can strengthen cyber defense considerably.

In addition, here are 10 quick cybersecurity tips to ensure everyone in your business is doing as much as they can to prevent a security breach:

- Don’t let your PCs go unprotected

- Move off Windows XP if you still have computers running it, as support and updates for Windows XP ended quite a while ago.

- Coordinate policies with processes

- Make sure everyone in your company is clear about your data-protection policies and what they can and cannot store on their personal computers.

- Keep sensitive data safe and isolated

- Do not use a general-purpose computer to store sensitive data. For example, don’t use the same computer to store sensitive data and check email or surf the web.

- Regularly review what information you store

- Check the information that’s being stored on your server(s). Verify that confidential and monetary data is sufficiently protected and not lumped in with everything else.

- Stay current with your laptop protection

- Confirm that you have automatic software updates and antivirus updates enabled and ensure firewalls are maintained.

Some other tips include:

- Plan ahead: Put a disaster recovery plan in place, including who to call when something bad happens, offsite backup in order to recover from fire, flood, physical theft, and hackers, and records of what (if anything) your insurance policy covers from down time to other costs associated with hackers.

- Be in good company: Develop a relationship with local law enforcement before you need to call on them in a crisis.

- Do your data homework: Collect computing logs and occasionally review them because they will prove valuable during incident response, helping you to learn what your computers normally do, so you can respond to cyber attacks faster and potentially spot hackers before a damaging breach.

- Consider managed security services: New cybersecurity technology, including the use of more sophisticated analytics, can be difficult for a small company to deploy. Managed security services can ensure that you are as well protected as larger firms.

- Support cyber protection and knowledge sharing: We all need to share actionable data on cyber breaches so experts can gain a community view of the shared threats that exist and hopefully fold those threats into analytic solutions that address the real risk of cyber threats.

- Take just a few minutes to find out a bit more about malware, spear phishing, malicious use of remote access tools, “watering holes”, denial of service, and ransomware. If your company has been attacked, be sure to report it the appropriate authorities.

Once you have the fundamentals in place, the next step is to investigate some of the breakthrough alternatives that will go much further in protecting your business. Today’s innovations include artificial intelligence or machine learning, and devaluation of data.

If you are a small business, look into P2PE or tokenization, which can be very cost-effective. Securing a business today with a very small budget is challenging, but ignoring cybersecurity is no longer an option.

Scott Zoldi is chief analytics officer at FICO, a cybersecurity solutions company.

12) Connected Shoppers

Salesforce recently released its “2015 Connected Shoppers Report.” The research explored current consumer attitudes, habits and use of technology as part of the shopping experience.

There’s more competition today than ever for retailers who are competing with the store down the street, online shops and sites and flash sale websites claiming to offer the best deals.

The new research shows that in order to succeed, retailers need to accelerate digital transformations to provide personalized, 1-to-1 customer journeys for customers.

2015 Connected Shoppers Report Key Findings

- 88% of shoppers who avoid going to physical stores during the holiday season do so due to the crowds (82%), limited parking (48%), convenience of online shopping (48%) and a lack of knowledge/service from seasonal employees (24%).

- 49% find the post-holiday gift return process difficult in stores.

- 31% of in-store shoppers want store associates to know what they have previously purchased in the store or online, but only 10% of consumers expect this to actually happen.

- More than 80% of consumers research products online before going into a store.

- Very few consumers surveyed in this report have downloaded retailer mobile apps or see a connection between retailers’ online, mobile or in-store channels.

- 48% of in-store shoppers believe they typically know more about a retailer’s product than the store associate.

- While 47% of shoppers continue to ask store associates for their opinions on products, 67% sometimes have doubts around whether associates are telling the truth.

- Half of consumers would be more likely to shop at a certain retailer based on the technology store associates use to assist customers.

- 28% of in-store shoppers believe robots could replace store associates.

- 36% of Millennials (ages 18-34) who shop at stores want retailers to know who they are when they walk into stores with location-based technologies.

- 61% of Millennials are willing to disclose their personal data and social media profiles to brands to get better service.

For a full copy of the report, go here.

13) The Importance of Seed Funding

A new venture financing study conducted by Will Drover Assistant Professor of Entrepreneurship at the Price College of Business at The University of Oklahoma and entrepreneurship professors from Babson College and Baylor University reveals that a venture’s source of seed funding—crowdfunding or angel funding—has significant implications for how VCs later assess prospective investments, playing what they view as an important certifying role. In short, to secure VC funding, the research suggests one’s source of seed funding can prove to be an influential factor. The study was published at a premier peer reviewed academic journal: Entrepreneurship Theory and Practice.

A few key takeaways:

Crowdfunding Investor Volume: The volume of a venture’s crowdfunding investors can impact how VCs assess an opportunity. However, a high volume of backers only exerts a positive impact on VC evaluations when that campaign is associated with a reward crowdfunding model, not lending or equity. Hence, investor volume matters to VCs in some funding models, but not in others.

Crowdfunding Platform Reputation: Ventures raising capital from a reputable platform (a platform with a reputation for funding high-success ventures) favorably influence later stage VC assessments. As such, given the proliferation of platforms across the globe, where crowdfunding capital is sought proves influential to VCs.

Reputable Angel Investor: The presence of a reputable angel can favorably impact a VC’s assessment, such that they more favorably evaluate ventures already funded by a well-known angel. When seeking seed funding, then, the individual angel selected can prove important in shaping how later-stage VC investors see that opportunity.

Reputable Angel Group: Attaining seed funding from a reputable angel group also exerts a favorable impact on the screening decisions of VCs. As such, pursuing seed funding from a well-known angel group can also prove to be an important determinant in shaping VC evaluations.

14) Can You Really Turn a Hobby into a Business?

Guest post by Nick Goode, Commercial Director at Sage One. You can contact him on LinkedIn or Twitter.

The whole hobby-to-business proposition is a little misleading—primarily because we need to rethink the word “hobby.” When we hear it, we think of those fun, voluntary pastimes that bring us enjoyment and help us make the most of our free time: reading, collecting stamps, community theatre—they’re all things that we do because we enjoy doing them. But is simply enjoying stamp collecting enough to translate your hobby into a successful, thriving, and sustainable career?

What we’re really talking about here is “passion.” When your hobby becomes something all-consuming—that thing you think about all day long during work and jump right into as soon as your time is yours again—that’s more than a hobby; that’s a passion with potential. And that passion is what represents something that can be both personally and professionally sustainable.

Here are a few areas to consider before taking the leap.

Social Media—It’s Already Working For You: Your first stop on this journey from hobby to business is unquestionably: Get Social. In my view, social media is still a relatively untapped resource—and it’s one tool every hobbyist already has at their disposal to do the most basic market research. Start with Facebook and search for people with businesses like the one you’re considering. Since it’s unlikely your idea is going to be of Tesla-level uniqueness within the small business community, there will be many similar businesses you can learn from. Which appeal to followers the most? Which are most successful and why? Steal ideas with pride and connect with followers to learn as much as you can.

When researching this topic, I immediately turned to my Twitter community for insight. Using the hashtag #hobby2business I posted a photograph, tagged eight of my followers from the small business world, and asked for their advice on turning a hobby into a business. Within an hour, coworkers from my office were retweeting and tagging others, and my feed was full of #hobby2business content and advice. My favorite? @PennyPower | Build community. Without social media, your use of it, and the connections you make with the people who will help you, your hobby will most likely remain just that.

Differentiate From Day One: What makes a good business? Remember the seven P’s of marketing: product, price, promotion, place, packaging, positioning, and people. As an entrepreneur, you’re going to need to define all of these things in order to figure out where you stand in the marketplace—and how you can do it better than everyone else.

First, intimately understand the product you want to sell. Even if it’s a service, think of it as a product—what are its features? Why are they appealing? What is the size of your target market, and what percentage of that market do you anticipate will buy it? What are others charging for something similar?

You’ll also need to consider the logistics of getting your product to the people who want to buy it. If you’re selling online, where would your consumers naturally go to get your product? eBay? Amazon? Your own website? What apps will you need to collect money and get paid? Will you need storage, packaging, or shipping services? These channels are your routes to market, so defining them will also help you build a strategy for finding customers and making it as easy as possible for them to buy from you.

And while it’s important to identify these things, don’t overthink it. Unless you are inventing a patented product (which is rare in the hobby-to-business landscape) you’re probably going to differentiate on price, service, audience, and the product itself in comparison to what’s already out there. Embrace these things and use them to help set yourself apart from the competition.

Business Is Both Fun and Dull All The Time: Fun is a small word with a huge impact on our lives, so it makes sense that we’d prioritize injecting fun into our business lives whenever possible. And, if you’re thinking about becoming your own boss, the ability to capitalize on fun is definitely one of the advantages: you can wear whatever you want, play music while you work, control the tone and presentation of your product—you’ll be in control of a lot of fun, new components of your business.

However, even the most fun business is still just that—a business. There are a lot of decidedly un-fun and dull responsibilities that your business requires to remain successful and profitable. Finance, administration, inventory—these are all things most small businesses owners do not go into business to learn how to do. That being said, there are ways to help minimize the impact of these dull tasks so you can focus on the fun stuff:

Get a bookkeeper or an accountant from day one. Explain that you are a very small business on a shoestring budget, and that you don’t need corporate advice—you just want to get the basics right.

You’re going to want mobile and online offerings first, so find a bookkeeper who does the same. You’ll get the advice and help you need without spending time and money traveling to meet them in person.

Use an accounting app that your bookkeeper recommends. Every dollar you spend on your business counts towards your success.

Learn the basics of accounting, invoicing, expense management, tax returns, and cash flow. Accept that your success depends on it. You don’t have to be an expert but you will fail without mastering the basics of accounting.

For everything else you need help with, use sites like Upwork and peopleperhour [or Fiverr] to get freelance help. These sites offer experts on demand and at an affordable price.

Do The Math and Get More Help: Fundamentally, every business needs to answer this simple equation to find success: revenue minus cost. To make sure your business is financially stable, start by figuring out how much income you need along with how much product you need to sell, and what your costs are. Then you’ll need to calculate how to manage the cash flow (the money you need to make the business work) as you ramp up. Keep going over these numbers.

If you are useless at numbers, don’t give up—get help! It’s a given that you will be weak in some areas of your business—after all, your passion for your hobby is not enough to keep a business up and running smoothly. The good news is that anyone in marketing, finance commercial management, product management, or your bookkeeper can help you. And don’t forget your friends and neighbors: your community includes people who will do things pro bono, provided that you can help them back. Be open to this. The social-first generation is all about mutual support (and that’s what makes it awesome!).

Your “Why” Should Not Be Because You Hate Commuting: In his book Start with Why?, Simon Sinek challenges what and how thinking. While what and how are the yin and yang of everything, why is the driving force. So why didn’t I start the article with the why? Because the hobby-to-business process is agile rather than step-by-step—you need to consider each of these areas over and over; you can refine your why as you go.

But first, ask yourself why you want to make a career out of your hobby? Boil down the essence of your purpose because it will drive you to success. Without identifying the why you will not tap into the real reason you are changing your life. If that sounds bold, it is—you’re changing your life for a reason and you should be able to explain what that reason is; whether it’s to save your health, become the person you were told you couldn’t be, or because the real you is not stuck in a call center, defining the real, fundamental reasons why you want to transform your passion into your business will help you ultimately be more successful. Try to complete this sentence: I am doing this to [enter bold life-changing statement here]. If we all did this, we’d change the world faster. Define the why today and reach for the highest branch.

Now more than ever we are encouraged to do what we love. After all, life’s too short for a boring job, bad bosses, and doing something you hate just to earn a paycheck. And because technology now enables work to be a thing you do rather than a place you go, the opportunity to identify and develop unique career pathways is greater than ever! For example, social, political, and environmental awareness has helped organizations such as Freecycle to flourish; a global movement toward embracing “makers” has built revolutionary sites like Etsy. We’re blessed, as a society, with an unprecedented combination of time, technology, information, and the quantified self: yes, we want it all.

And we can have it, too—as long as we channel our passions in the right places. For all of you who are thinking about turning your hobby into a business, I hope you found these insights helpful and I wish you luck!

15) Global Optimism

Top executives of small and medium-sized enterprises (SMEs) in the United States are among the most optimistic about future business opportunities compared to the rest of the world, according to Zurich Insurance Group’s (Zurich) Third Annual Global SME Survey.

The U.S. was included in the study for the first time this year.

The outlook of U.S. SMEs was most optimistic—the response “I don’t foresee any opportunities for my business at present” ranked last out of eleven potential opportunities posed, and received fewer responses (5.5%) than any other region. “Cost and expense reduction” was ranked highest (39.5%), followed by “new customer segments” (28%), “new sales channels” (25%) and “expansion to foreign markets” (16%). In other parts of the world, “diversification of product range or services” (Asia-Pacific) and “cost and expense reduction” (Europe) ranked highest.

From a risk standpoint, SMEs in the U.S. identified their top concerns to be “high competition” (35%) and “a lack of consumer demand” (30.5%), on par with the rest of the world. Despite this correlation, of the fourteen potential business risks surveyed, the U.S. ranked “technological vulnerabilities” (15%) and “cybercrime” (13%) highest of all the regions.

Learn more about the key risks and biggest opportunities.

16) Waiting to Implement EMV Terminals is Risky for Merchants

Guest post by Julie Pukas, head of U.S. Bankcard and Merchant Service, TD Bank

There was much buzz leading up to the October 1 EMV liability shift. Were major retailers ready? How would consumers adapt to dipping their cards instead of swiping? And perhaps the most important measure of success for the U.S. adoption of EMV technology, would small businesses make an investment in EMV terminals, or were they willing to risk being held responsible for fraudulent transactions?

Research conducted by TD Bank shows many small business owners are choosing to become complaint, but face challenges and concerns. A survey fielded between Oct. 1 and Oct. 7 reveals that 41% of U.S. small businesses installed EMV chip-enabled payment terminals to meet the liability deadline, while another 40% plan to make the switch soon. Only 19% say they don’t plan to install EMV payment terminals, or are not aware of the new EMV compliant rules.

It’s encouraging to see that many businesses are making the EMV switch. However, if we want the EMV liability shift to be effective, smaller merchants need to install EMV terminals.

When business owners are deciding whether to adopt EMV terminals or keep older payment technology in place, they are usually impacted by two factors: security and cost.

Our survey revealed that 73% of SBOs [small business owners] do not feel vulnerable to fraud. The reality is that SBOs have a false sense of security about fraud, as Javelin Strategy & Research found, in 2013 about 10% of U.S. small businesses were victims of payment fraud, including the type of credit-card fraud the switch aims to prevent.

The new rules indicate that the least compliant party with EMV technology—the business or card issuer—will be held liable in the event of a fraudulent transaction. SBOs must consider the potential consequences of not installing EMV terminals.

Past experiences have SBOs confident that they won’t experience a fraudulent transaction. But without the new EMV terminal, one fraudulent transaction can cause a significant financial burden for the business.

Our research identified that SBOs who plan to obtain the new technology are concerned about the cost associated with switching to chip-enabled terminals. Yet small businesses that have installed the terminals reported spending on average $450. While this might mean temporarily paring down other expenditures for the smallest of merchants, many SBOs can likely find the dollars in their budget for that investment.

This investment should not be taken lightly as it serves almost as an insurance policy. With the average cost of fraud from stolen or lost information at $145 per record, according to a 2014 study by Ponemon Institute, a small business with even a dozen payment customers could be facing a hefty financial burden if they are victims of fraud.

Purchasing the EMV terminal is only the first step. What makes the process successful is a business owner’s commitment to training and proper installation. The liability shift is about adding a layer of fraud protection for consumers, and if we want the adoption of EMV cards to be effective, business owners to train staff and properly install the terminals.

More than one-third of SBOs who have or plan to invest in EMV terminals also indicated the time involved to set up and learn the system and explaining the new process to customers were of concern. This is a time of change, for SBOs and consumers alike, but considers it as another touch point with your customer.

What’s even more troubling is that some businesses have purchased new terminals but haven’t activated the EMV chip reader, rendering the terminal essentially useless. These SBOs are losing the security benefits that EMV terminals bring.

This may only be the beginning of a longer journey for the U.S. payments industry, but EMV technology is here to stay. For small businesses that are waiting to make the switch, it’s about time to sit down and consider whether the risk is worth the potential financial loss and long-term health of their business.

Cool Tools

17) Experience the Incredible Growth of Social Media in Real Time

This is one of the most fun—and useful business tools I’ve seen in a long time. Now you can see the meteoric growth of the top social media sites, with the Social Media in Real Time counter.

Zuzana Padychova from Coupofy explains:

Unless you’ve been living under a rock you know social media platforms such as Facebook and Twitter are hugely popular and arguably as groundbreaking as the telephone was when it comes to our ability to communicate and socialize. In fact the medium is so big that one in seven people in the entire world logged on to Facebook on August 24, 2015. That’s more people than used their cell phone to make calls or texts.

The Social Media in Real Time counter was created by Coupofy to attempt to illustrate the sheer scale of social media use, particularly the speed in which it’s growing.

Sure, 16 million monthly new Facebook users is an impressive figure, but unless you see this represented visually it doesn’t quite sink in. The real time graphic takes the top 9 most popular social media sites shows all the key indicators growing before your eyes as the timer ticks. The backend data is based on the latest publicly available statistics.

Platforms included are Facebook, YouTube, Twitter, LinkedIn, Pinterest, Google Plus, Tumblr, Instagram, and Reddit. It also takes a closer look at the accounts of celebrities like Katy Perry and soccer superstar Cristiano Ronaldo.

When the counter was put to test for nearly 4 hours some of the figures were quite astonishing. On Facebook for example 36.4 million messages were sent, 71.2 million statuses were updated, over 12.1 million links were shared, and a whopping 33 million photos were uploaded. With growth also come more friends—to the tune of 24.3 million friend requests. It would be interesting to know how many people accepted those requests.

Likewise when paused at 94 minutes nearly 8 hours worth of footage had been uploaded to YouTube, while 263 million videos were watched—65 million from mobile devices. Can you imagine how many hours of video are uploaded in just a single day?

Of course when it comes to numbers it’s celebrities that have the largest social media accounts. Music icon Katy Perry for example has an astounding 77.6 million Twitter followers. As the counter shows, this means she gets 27 new ones every minute. This is partly because she is super popular and successful, but also because Twitter’s algorithms put her high in the suggestion list, which is compounded when other people who follow her are connected to you.

Switching back to YouTube the elusive Adele released her new single “Hello” in October and by November it had been watched over 300 million times—the fastest watched music video (any video in fact) of all time. According to the counter it managed a further 1.37 million views in less than 100 minutes.

Soccer sensation Cristiano Ronaldo has managed to leverage his world-class profile in the world’s most famous sport to net over 107 million Facebook fans. This means he gets over 100,000 new fans in just 6 days.

Whether you just want a bit of fun observing the number of new Facebook users there are in the time it takes to make a sandwich, or you want to use the data to ask the big questions about how social media is impacting our society—check out the Real Time Social Media counter today.

Presented by Coupofy

18) Invoicing on the Go

Invoice2go just launched a new payments feature t in partnership with Stripe, that allows small business owners and freelancers to send invoices, get paid and track cash flow/outstanding payments all within one app. This mobile payment feature could be a game changer for the 200,000+ small business owners and freelancers who are already invoicing more than $1 billion per month through the app.

19) Business Startup Checklist

Intuit recently launched a free online tool on its Small Business Center site to help startup business owners. The step-by-step interactive guide provides a checklist for those wanting to start a new business.

Startups face a lot of challenges. Those noted in a recent Intuit survey include:

- 68% wish they had more guidance about how to start a new business

- 60% find it hard to figure out the steps needed to start

- 56% say starting a business is confusing

An earlier study from Intuit showed:

- 64% of startups start with less than $10,000

- 75% use their personal savings as the primary source of funding

- 68% say the first year in business is either the most—or more—difficult than most other years

The tool guides startups through six key areas needed to launch and run a small business:

- Setting Up

- Getting Paid

- Creating a Website

- Doing Accounting

- Hiring

- Getting Advice