By Rieva Lesonsky

1) Santa’s Not the Only One Making a List

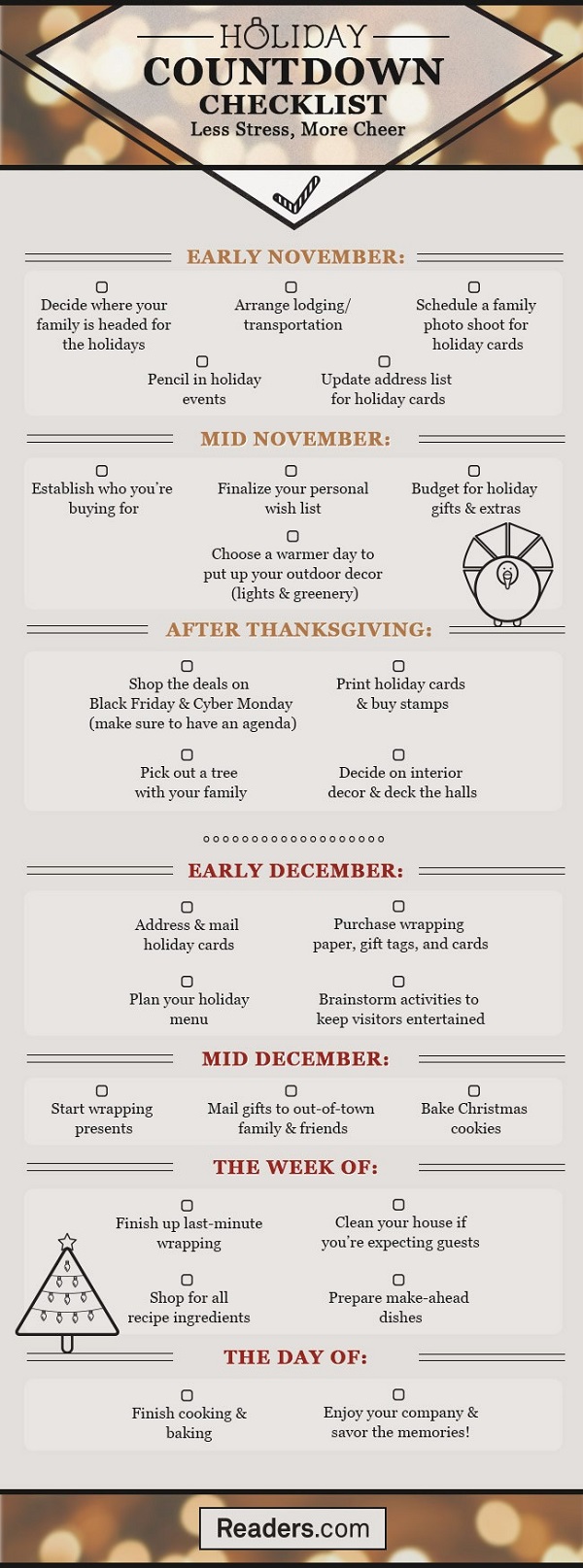

With the holidays quickly approaching, a holiday checklist is a must for busy entrepreneurs trying to balance work and family. To help bring less stress and more cheer, Readers.com has created you get organized.

2) Black Friday Emails? Send Them Now

According to a study from Yesmail, consumers are opening Black Friday-themed emails early in the week and become less interested in them as the day approaches. If you want to successfully engage your email subscribers, send your Black Friday teasers between Sunday and Tuesday and then follow up with messages featuring your Black Friday deals on that day, when, presumably, consumers are already thinking about your company, due to the emails sent earlier in the week.

Download this free report from Yesmail to get all the details.

3) Socially-Responsible Companies Attract More Shoppers

Holiday shoppers are doing more than searching for the best deals. According to a survey from Aflac, a company’s reputation, corporate social responsibility programs (CSR), and philanthropy play a large role in consumers’ final purchase decisions. And, businesses with one-off philanthropic efforts (as opposed to year round) are less appealing.

Key Findings:

- Philanthropy is more top of mind for Millennials than those 35 and older.

- Consumers say social media platforms are best for raising awareness for a cause, rather than

- People with children are more inclined to give back and take company ethics/CSR programs into account when purchasing, job searching, and investing.

- Men are more likely to take CSR and ethics into account when searching for a prospective employer than women.

- 65% of people link diversity with a company’s ethical standards.

- 81% of consumers are more likely to purchase from corporations who are active in philanthropic efforts year round as opposed to only in times of need

- 82% of Millennials believe companies that stay true to their ethics/values outperform others in their field.

- 92% of Millennials are more likely to purchase from an ethical company. When a company is looking to raise donations on social media, Millennials are more likely to engage with video

Aflac does more than report on this. Over the past 20 years it has donated more than $100 million to the fight against childhood cancer through its Duckprints program. You can check out the CSR factsheet here.

4) What’s Your EQ?

Being a successful leader in any field requires more than just hard work and good luck. For those looking to increase their leadership skills, one of the most important areas they should excel in is upgrading their emotional intelligence.

Emotional intelligence, also known as emotional quotient (EQ), is the power to comprehend, access, and produce emotions in others, as well as ourselves. By doing so, we are able to better understand emotions, which can assist in regulating them and boosting our intellectual and emotional growth. Research has shown a direct and positive correlation between success in the workplace and a high EQ. Many politicians and CEOs are masters of EQ and use it to make themselves and their teams extremely accomplished and profitable.

Studies conducted over the last 40 years show the numerous benefits of effectively using EQ techniques. High emotional intelligence leaders choose battles wisely, are assertive when necessary, and have the confidence to take on any difficult situation. They understand the moods, drives, and emotions of both themselves and others, and use that knowledge to their advantage. EQ leaders consistently outperform their counterparts and use it to remedy all types of organizational problems that arise when working with a team. Conflict resolution, settling differences in attitudes and outcomes, and eliminating disagreements are just some of the problems EQ can solve. When it comes to predicting who will be successful studies show Emotional Quotient is 4 times more effective than Intelligence Quotient (IQ).

Emotional Intelligence and success go hand in hand. If you are looking for ways to become an effective leader, taking a course in EQ could be the answer.

For more about EQ, check out the infographic below from Norwich University Online.

5) What are the Chances Your Employees will Sue You?

Hiscox, the global specialist insurer recently released a new study of employment practices litigation, the 2015 Hiscox Guide to Employee Lawsuits, showing companies based in New Mexico face the greatest risk nationwide, with a 66% higher chance of facing an employee charge than the national average. Other states and jurisdictions where employers are at a high risk of employee charges include Washington, D.C. (65% above the national average), Nevada (47%), Alabama (41%), California (40%), Mississippi (39%), Delaware (35%), Illinois (34%), Arkansas (22%) and Tennessee (20%).

Hiscox claims data for businesses with less than 500 employees indicate that 20% of businesses will face employment charges with an average cost to defend of $125,000, which includes expenses such as attorney’s fees and settlement costs. For those with insurance coverage, the average deductible cost was only $35,000, compared to the $90,000 balance paid out by their insurance company. The median judgment for cases that go to trial is approximately $200,000 for employment lawsuits adjudicated by the courts, while one-in-four cases resulted in a judgment of $500,000 or more.

6) Employee Engagement Initiatives Aren’t Actually Engaging

Poor employee engagement costs companies billions. According to the Gallup Organization’s State of the American Workplace Report, U.S. companies lose between $450 billion and $550 billion due to employee disengagement. To respond to this critical need, employers are attempting to initiate and measure employee engagement programs. However, according to Part III of theEMPLOYEEapp’s 2015 Mobile Trends in the Workplace survey, the question still remains whether these programs, and the ways in which companies are communicating with their workforces, are effective.

According to the survey, 71% of employers have employee engagement initiatives in place. However, of those, only 37% believe their employees are actually engaged. Respondents indicated that half of their employees are “somewhat” engaged and 12 percent believe engagement is a significant problem.

“Employee engagement continues to be a major challenge for companies and it is the number one challenge we hear from the many internal communications and human resource professionals that we speak to daily,” says Jeff Corbin, founder and CEO of theEMPLOYEEapp. “As the workforce population continues to skew younger, employers are now being forced to think outside of the box and reimagine how employee engagement can be accomplished. Based on the results of our survey, there is a lot of room for improvement.”

To address the problem of poor employee engagement, approximately half of the companies surveyed conduct baseline surveys and use the results to build and modify programs. When it comes to building and implementing engagement programs, the following tactics and strategies were utilized most by the responding companies:

- Training courses (72%)

- Open door policies (71%)

- Flextime and telecommuting (68%)

- Reimbursement or paying for industry memberships (61%)

- Tuition reimbursement (59%)

- Employee assistance programs (59%)

As was shown in the first two parts of theEMPLOYEEapp’s survey, the ability for employees to easily access information and to be more productive in their work directly correlates to enhanced employee engagement. In addition, the frequency and method of communications are of significant importance. Part III of the survey confirmed these findings, this time from the perspective of the employer.

Employers agreed that the way in which a company communicates with employees directly impacts engagement (91%). However, given the changing demographic of employees and, in particular, Millennials, they don’t feel their companies utilize enough digital communications tools to communicate. Rather, old school communications methods like email (98%) and face-to-face communications (90%) are the norm. And despite the proliferation of mobile technology, only 16% use mobile apps to communicate with employees.

Corbin says, “Not only do employers acknowledge the problems their companies face with respect to engagement, but they also recognize the importance of communications to improving it. The failure of their companies to stay ahead of the technological curve and to appeal to the needs of their employees will only become more evident as lower productivity, due to lack of engagement, continues.”

To learn more about theEMPLOYEEapp’s 2015 Mobile Trends in the Workplace you can also register for their free webinar taking place November 17th at 2 pm ET.

7) 3 BYOD Risks and Solutions for SMBs

Guest post by Brian Sutter, Director of Marketing, Wasp Barcode Technologies. You can connect with Brian at @SmallBizBrian, Google+, and LinkedIn.

Today, many of us enjoy a seamless technology experience—moving from our smart homes, to our connected cars and into the workplace without missing a beat (or a swipe).

These capabilities have created a new trend in business: BYOD, shorthand for “bring your own device”. Smartphones are the most common example of a personal device that might pull double duty as an in-office resource, but many employees also take their own tablets, laptops and USB drives into the workplace.

Today, BYOD is usually an elective phenomenon, but that may soon change: 38% of companies expect to stop providing devices to workers by 2016, according to a global survey of CIOs by Gartner, and by 2017, one in two firms will no longer provide devices to their employees. With 38% of small businesses planning to expand their workforce in 2016, according to Wasp Barcode’s State of Small Business Report, the amount of employee-owned devices will only increase.

The boom of BYOD is a double-edged sword for business owners—especially SMBs. On the positive side, it opens the door for workforce mobility, supports 24-hour staff accessibility, and creates quality of life conveniences for employees. Some 19% of firms believe BYOD is a way of improving employee satisfaction. And a further 17% of companies feel BYOD could improve productivity in the workplace both now and in the future.

Although an attractive business model, BYOD can also introduce huge risks for employers. To help, we’ve compiled a list of the 3 biggest BYOD risks and (affordable) solutions for small businesses.

Risk #1: eDiscovery Access

Today’s smartphone is basically a pocket computer, capable of accessing multiple data streams (including corporate networks) and storing vast amounts of information.

This is convenient, but it also presents unique legal and IT challenges—especially for resource-taxed small businesses who need to safeguard, retrieve and control company-owned data. This is where the challenge comes in: In eDiscovery terms, BYOD policies give you about as much control over employees’ mobile devices as you have over their fashion choices.

In exchange for the privilege of connecting a personal iPhone to the corporate network, most companies require the employee to agree to a mobile device security policy. This gives the company a degree of control if the mobile device is lost or if it becomes necessary to collect data from it. These measures are the first step toward setting a company up for mobile eDiscovery success.

If you’re creating your first eDiscovery-oriented BYOD policy, make sure you’re granted the ability to remotely lock and disable the device, wipe all data from it, track the device and access data on the it, including user-created email and files, application logs, phone records, GPS files, and more. This can (and often will) include personal data, so it’s important your employees fully understand the terms of BYOD use to protect all parties involved.

In the early days of BYOD, legal and IT departments encouraged the use of applications that passed data through corporate servers, where, if the data became subject to discovery, it would be available and under company control on its servers. This often eliminated the need to collect from the mobile device itself.

Today, unique data will reside on mobile devices because they make extensive use of apps and cloud services. And that means BYOD mobile devices will be involved in day-to-day discovery.

The good news is: specialists in eDiscovery can take some of this burden of responsibility away from small business owners. One example is DriveSavers, which has performed over 500,000 successful recoveries since it began in the 1980s, from phones, tablets and PCs of all types. They’ve worked with celebrities, government organizations, and private businesses and citizens to recover important data from losses such as fire, hard drive failure and water damage.

Recently DriveSavers even announced new capabilities in accessing data from anonymous prepaid cell phones, or “burner phones.” Tens of millions of these prepaid cell phones are currently in use, containing previously unattainable data. DriveSavers’ new solution creates new safeguards for BYOD businesses that might have employees using these devices on the job.

Risk #2: Security

Cybertheft is a prominent threat to American businesses: According to one Dell study, security breaches cost U.S. organizations an estimated annual loss of $25.8 billion.

That’s why even small businesses must adopt a mobile device management (MDM) strategy that protects sensitive information from data theft. MDM plans allow companies to have greater control over the range of technologies being used by employees, and provide workers access to company information from one secure location that is separate from their personal applications. This means that employees can use their phones for personal and business functions without compromising the security of corporate data. Meanwhile, companies can assure that workers’ privacy is respected by keeping documents like text messages, photos and videos off-limits from IT workers.

Mobile application management software is also key. One of the most common ways for cybercriminals to gain access to company information involves installing malware on employee devices. Malware programs can be disguised as consumer apps available on third-party app stores, so it may be difficult for employees to recognize the harm in downloading such offerings. Fortunately, mobile application management software enables IT workers to control which applications can be installed on employees’ devices. After IT teams install MAM programs on workers’ smartphones, they can blacklist vulnerable apps from being installed.

Finally, employees can protect their phones with a data protection program like Fortegra’s ProtectCELL. ProtectCELL’s plan provides security beyond mobile phone insurance, so smartphone owners can ensure they are keeping both personal and corporate data safe and offers the ability to locate and lock lost devices and erase sensitive information.

Risk #3: Loss, Theft and Resale

More than 1 in 3 mobile devices are either stolen or lost by their original owners.

And employees that sell or recycle a BYOD device after upgrading pose another risk. In either event, when personal devices fall into the wrong hands, your company data could, too.

How do you protect your assets from this threat? First, enable remote wiping of the device’s data and require it as a condition of program participation. Not only does it safeguard devices lost, stolen or sold, it can provide protection against loss of data to disgruntled former employees. When a team member is terminated, you can erase any corporate information or apps from their phones.

8) Motivators for Business Startup

Making more money is not always the reason people start a business, or so says the 2015 First Citizens Bank Small Business Forecast. While the Baby Boomer business owners surveyed says they started their businesses to generate additional income, Millennial entrepreneurs say chasing a dream and taking control of their careers fuels their ambition. And Generation X respondents felt the most strongly that they could do a better job owning a business than working for someone else.

Regardless of age, the study uncovered a thriving and growing entrepreneurial spirit present among U.S. small business owners. The entrepreneurial spirit is particularly high among women and Millennials. More than 40% of the female entrepreneurs say starting their own businesses gave them an opportunity to realize a dream.

The 2015 First Citizens Bank Small Business Forecast also found:

Optimism surrounding the future of business success and the U.S. economy is high. Millennials (80%) were the most optimistic. The top contributing reasons to start a business included having more flexibility and work-life balance.

The outlook on future growth is also high. Of all small business owners surveyed, 73% plan to grow their businesses in the next six to 12 months by adding new products or services, increasing their advertising or marketing spend and upgrading current facilities or equipment.

9) Solving the Small Business Credit Crunch

Intuit just released a new research report, Financing Small Business Success, which examines both the traditional lending process, as well as new online options. The report, prepared by Emergent Research, builds on existing research showing challenges with the traditional system. For example, small businesses spend an average of 33 hours on paperwork for bank loans, and small businesses loans on the balance sheets of banks are down about 20 percent since 2008.

The report shows how alternative lenders are reshaping the small business financing market by streamlining the loan application process and more accurately assessing credit strength. Highlights include:

Small Businesses Use Financing To Fuel Growth: The average small business loan is $83,000, and the top three uses of financing are: purchasing new equipment (35%), working capital (29%), and new production or service space (13%).

Traditional Application Process Relies on Personal Credit History: Only 34% of small businesses can access all of the funding they need from the traditional financing system, which relies on outdated methods of measuring credit strength. For example, 83% of businesses with fewer than 11 employees rely on their personal credit history to apply for a business loan.

The Online Lending Process is Faster and More Efficient: Alternative lending streamlines the application process by enabling small businesses to use data from sources such as QuickBooks Online to apply for loans with the click of a button. 77% of small businesses say they would use a loan application system that makes the process easier by pulling data directly from their accounting solution.

Online Lending to Small Businesses Projected to Grow Dramatically: The study projects that online lending to small businesses will grow from an existing base of $9 billion in 2015 to $83 billion by 2020, moving from a mere 1.3% of the small business credit market to 10.5% in five years.

10) Small Businesses Say Skilled Labor is Hard to Find

According to October data from job site Indeed’s Small Business Index, small businesses are struggling to hire skilled and specialized labor. The stats show 33% of electronic equipment installation and repair positions were still open after 90 days. This is followed closely by chiropractors and painters (32%), brickmasons (30%) and machine tool operators (27%).

“Rising housing starts are creating more demand for some of these positions, which is great news considering economic growth has slowed a bit,” says Jason Whitman, SVP of Client Services at Indeed, who oversees the small business service team. “However, small businesses have a lot of competition for specialized employees, which means it can take longer for them to fill these types of jobs.”

While some businesses are struggling to find specific talent, Indeed data also finds small businesses are looking for sales and finance professionals, which shows, says Whitman, “small businesses are looking to grow as we head into the end of the year.”

Personal services (such as fitness trainers and childcare), transportation and food service employees are also in high demand by small businesses.

Indeed data shows 81% of small businesses are hiring fulltime employees.

Indeed works closely with small businesses to help them post jobs and hire talent. Its small business data represents U.S. companies that employ less than 500 people.

11) The Power of Employee Benefits

If you’re one of those small businesses referenced above finding it hard to attract qualified workers, you’ll be interested in the results of MetLife’s 13th annual U.S. Employee Benefit Trends Study (EBTS), which found small business owners and employees agreeing that offering a wide range of employee benefits supports loyalty and retention. In turn, increased loyalty and retention supports an employer’s ability to grow and scale the business. Specifically, the data shows:

- 65% of small business employees say having benefits tailored to their needs would increase loyalty.

- 57% say having a wide range of benefits to select from would make them feel more loyal.

- 67% of small business owners believe the potential to boost employee retention and loyalty is a factor when making benefit decisions and choices, followed by the potential to increase employee motivation and productivity at 62%.

12) 3 Social Media Marketing Musts for Introverts

Guest post by Kim Staflund, founder and publisher of Polished Publishing Group (PPG), and the author of Successful Selling Tips for Introverted Authors. You can connect with Kim Staflund on Twitter, Google+, LinkedIn, and Facebook.

What an amazing world we live in nowadays. You can quite easily promote yourself and your business without leaving your couch. This gives introverts a worldwide audience, no matter where you start from. No need for forced interaction, small talk, or gregarious chatter. The Internet is the great equalizer. You don’t need to be the master networking champion of the office, or the center of the company cocktail party. If you’re an introvert and want to promote yourself or a product, all you need is an Internet connection and a plan.

Here’s how.

Get a Storefront

Just as it is for businesses inside a traditional shopping mall, your online market is a fluid and ever-changing stream of old and new customers. When they’re ready to buy whatever it is you’re selling, you want them to recall you and your business ahead of all the others. In the world of advertising, sales, and marketing, this is known as creating top-of-mind awareness.

Some of the traditional ways that businesses create top-of-mind awareness are to place regular ads on television, radio, and billboards, or in print media outlets such as magazines and newspapers. Repetition is the key to success in any advertising campaign, and this can get pretty expensive. We’re talking hundreds, maybe even thousands, of dollars per month to run enough ads to achieve top-of-mind awareness with the general public, depending on how large a trading area you’re trying to reach. Luckily, there’s a more sensible, modern option: Get yourself a website. Don’t shirk at the cost or try to sidestep around it. Websites are the new storefronts, and it’s not as hard as you think.

With enough comparative shopping, you can find someone to build your website at a reasonable cost—unless you’re savvy enough to build your own through a free or low-cost service. If you’ve got something to sell, a website is worth the investment. To find the best company for you, dig around online (as an introvert, you’re probably good at that). Read testimonials. Ask for referrals.

Make sure your website looks professional. It doesn’t need a lot of bells and whistles, but it does need to look polished, even if the template is simple.

And make sure the site is easy for you to maintain.

Get Blogging (But Do It Right)

Blogging and social media marketing combined is word-of-mouth advertising on steroids—which is great news for introverts. You can talk about yourself without talking about yourself.

Some of your keywords, like your business name, might have a fairly high search engine ranking, depending on the nature of your business. Blogging can help to improve that. The idea is to write several short, effective posts—think of them as 500-word essays that contain the phrases your customers type into a search engine when they are looking for your particular product—and then share those articles with others via email and social media websites. The ultimate goal is for your articles to show up in the top five search results on page one of a search engine because this will dramatically improve the chances of being seen. Obviously, the more articles you post, and the more often they’re shared by others on a regular basis, the better it will work.

What makes for an effective blog post? It needs to be useful to your reader, true to your business or product, and something that can go viral. Make your language clear, concise, and consistent.

Get Social

Now that you’ve got your storefront and your blogging underway, you also have the benefit of free social media websites to super-charge both. We can talk about Twitter and Facebook, but if you’re in it for business and networking, LinkedIn is still a safe bet. Here’s a few tips on the smart way to get “linked in”:

- Build your audience gradually by posting relevant and informative blog entries twice a week to groups that are interested in your topic matter, and only occasionally as status updates directly from your profile page.

- Once you have connections and an audience, don’t push people too hard. Don’t, for example, send people unsolicited email requests to buy your products.

- Engage in conversations with those who post comments to your blog entries and status updates. Let your audience get to know you by replying to their posts and answering their questions. Again, this is gold for the introvert. You can have meaningful conversations in a controlled environment, all while wearing your pajamas.

13) Small Business Employment Remained Stagnant in October

Intuit Inc. recently released its Small Business Employment and Revenue Indexes for October showing U.S. small business employment grew only slightly, increasing 0.01%. Hourly employees worked an average of 113.1 hours, an increase of 0.6% from September. This is an increase of an additional of 45 minutes per month.

Small business employees’ average monthly pay also increased by 0.6%, bringing average monthly compensation to $2,904. This is $17 more than they were paid in September.

Revenue per small business was down by 0.3% across all industries, which translates to an annualized decline of 3.9%.

Arizona, Virginia and Nevada had the largest employment increases, while the biggest declines were in Wisconsin, Massachusetts and Maryland.

Cool Tools

14) Instant Money

In the world of entrepreneurship, it can be tough to self-finance budding businesses. Yet, a consistent cash flow is critical to startup success.

For those of you who still have jobs while you support your startup there’s now an app that gives you quick access to your paychecks when you need it–essentially on demand.

Activehours allows workers to access their earned wages before payday. Users simply upload their timesheets to the app. When you want your money, Activehours provides it and then later automatically deducts the amount advanced—but only after your regular paycheck has been deposited into your bank account.

Built on the principle that people should not have to wait weeks to get the pay they’ve already earned, the company has no set fees to use the service—users just pay what they think is fair.