12 Things Small Business Owners Need to Know

By Rieva Lesonsky

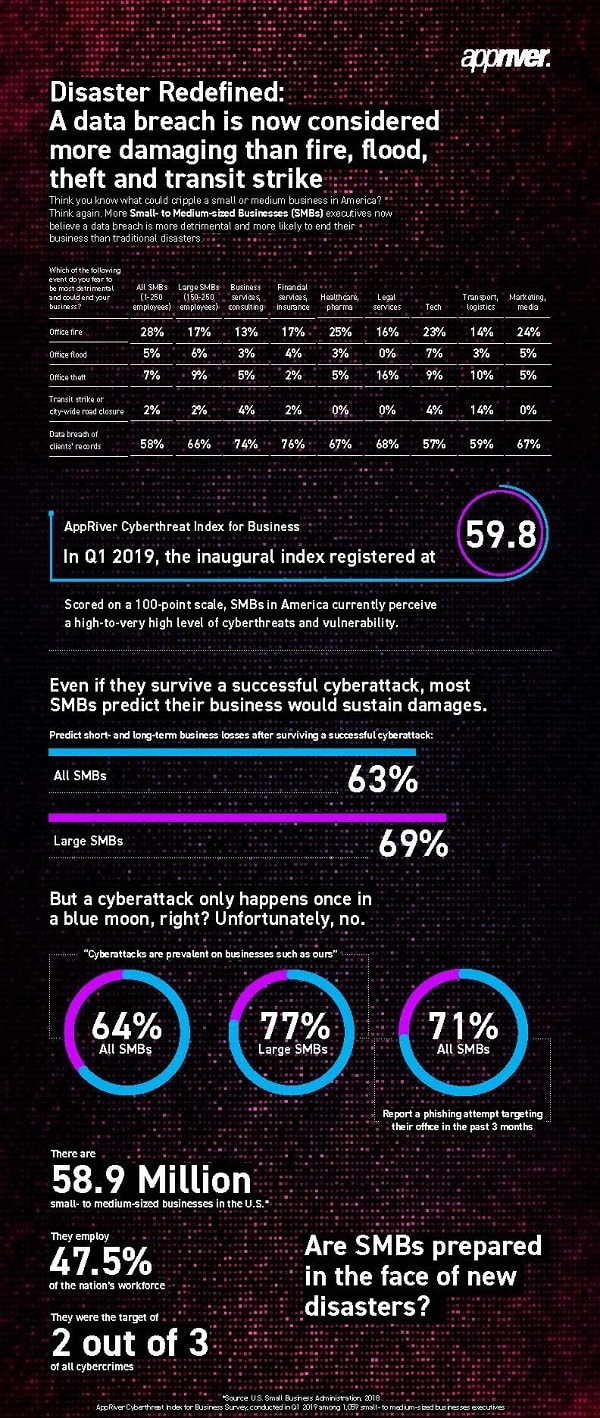

1—Cybercrime Devastates SMBs

A majority (58%) of SMB executives are more concerned about suffering a major data breach than they are about a flood, fire, transit strike or even a physical break-in of their offices, according to the inaugural AppRiver Cyberthreat Index for Business Survey.

“In today’s digital age, businesses rely more heavily on their intellectual assets than physical properties—bringing cybersecurity to the forefront,” says Dave Wagner, CEO of Zix Corporation, parent company of AppRiver. “The AppRiver Cyberthreat Index for Business Survey findings punctuate this evolution of American business, and also illustrate areas where business leaders are unprepared for cyberattacks.”

For 48% of SMBs, a major data breach would likely shut down their businesses permanently. The percentage increased significantly with 71% of financial services and insurance SMBs reporting a major breach would be fatal to their businesses. Healthcare and business consulting SMBs followed at 62% and 60% respectively.

The survey also shows SMBs are more concerned about attacks from disgruntled ex-employees than highly publicized threats from nation states, or even cyberattacks from competitors, rogue hacktivist groups or lone-wolf hackers.

Learn more in the infographic below.

2—March Madness Begins

March Madness kicks off this week, and according to Captivate’s Office Pulse 45% of U.S. business professionals plan to watch the college basketball tournament this year. Of course, that leads to about $604 million in lost productivity. Here’s the scoop”

The Office = The Sports Bar?

According to Captivate, 24% of business professionals plan to watch during work hours. Whether employees are permitted to watch is up for debate:

- 52% of managers embraceMarch Madness viewing during the workday—an attitude most represented among higher grossing managers (HHI of 100k+) with 64% allowing the activity

- But 25% of business professionals indicated their employer has either banned office poolsor blocked access to streaming sites

Around the Watercolor

In offices where there will be an office pool, 69% of business professionals plan to participate. Gen Xers are most interested—78% will partake. We’re not talking a lot of money though, 61% of business professionals plan to spend less than $20 in their office pools.

3—Embracing March Madness

Tips for managing March Madness from Jim Van Til, manager of HR services, Insperity

Although we know there will be productivity losses during March Madness, managers can flip the script by using this time as an opportunity to improve morale, encourage team bonding and reward employees for their hard work.

Here’s how:

Foster team spirit: Managers can use the tournament as an excuse to have fun in the office during an often-stressful time of year. The energy and excitement surrounding March Madness can help build stronger bonds between colleagues, especially if fostered by company leaders. Managers may consider taking time to discuss the games with team members, encouraging them to bring their excitement and team spirit into the office.

Make it a party: To encourage employees to socialize, managers may consider hosting a watch party for a game that is scheduled to tip off during work hours. If budgets allow, managers may order pizza or provide other snacks for the event and encourage employees to drop in and watch parts of the game in a spare conference room.

Relax the dress code: On big game days, managers may encourage employees to wear school colors or jerseys to show their team spirit. While it may not seem like a huge perk, many employees who work in a formal office environment appreciate the opportunity to relax on occasion. A temporary relaxed dress code can help forge new friendships by fostering conversations about teams or alma maters.

Set boundaries: Even with the fun surrounding March Madness, normal business operations must continue. With streaming services on computers, phones and office TVs, games and updates are constantly available to employees. Managers may consider allowing employees to watch games during business hours as long as they continue to complete work and projects on time. Leaders should also remind employees that not everyone is interested in the tournament. Therefore, noise and other disruption should be limited by using headphones when possible and discussing games at a respectful volume.

4—10 Rules of Blogging You Must Know

It might seem like a lot of work to start a blog and fill it with content, but there are a ton of benefits that you might not know about.

The first thing you need to know about is keyword research, and how utilizing it properly to populate your blog with articles about subject matter that people are searching for on the internet.

There’s lots more information in the infographic below from StartBloggingOnline.

5—Small Business Loan Approval at Big Banks Hits New High

The loan approval percentage for small business credit applicants hit a record high of 27.2% at big banks ($10 billion+ in assets) in February, while approval rates at small banks, alternative lenders and credit unions dipped slightly, according to the Biz2Credit Small Business Lending Index™ for February 2019.

“Overall, the cost of capital is relatively low, small businesses are looking to secure funding, and for many companies, recent financial performances have made them creditworthy borrowers,” says Biz2Credit CEO Rohit Arora. “Money is flowing to small business borrowers, while the cost of capital is still reasonable—especially traditional bank loans.”

- Smallbank approvals of small business loan applications dropped from 49.8% in January to 6% in February.

- Institutional lendersclimbed slightly to 2%, from 65.1 % in January. Loan approval rates among alternative lenders dipped from 57.3% in January to 57.2% in February.

- Credit unionsapprovals dipped slightly from 40.3% in January to 2% of loan applications in February.

“The economy is still solid, and overall the approval rates for small business loans in February were stable,” adds Arora, who oversees the Biz2Credit research. “There are no major macro issues in the economy right now. Although 2019 may not be as good as 2018, we are still in very good economic times. This is beneficial for small business owners in search of capital.”

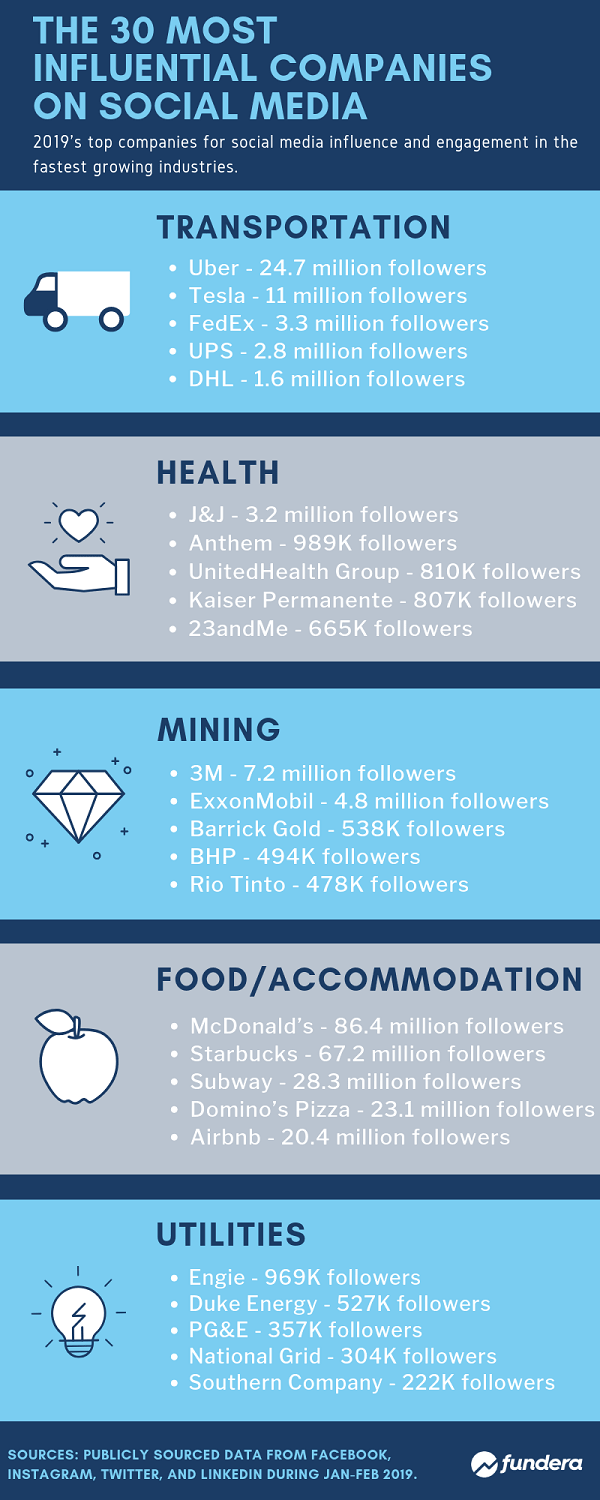

6—30 Most Influential Companies on Social Media

Last year, many people claimed social media was dead as a marketing medium. It’s true that some social networks had a tough 2018—Facebook’s number of monthly active users declined for the first time in June of last year, due to political scandals and privacy concerns. Twitter also shed 9 million users during the third quarter of 2018, as part of its efforts to deactivate fake accounts.,

Despite these losses, overall social media use is expected to climb in 2019. Instagram and LinkedIn are both adding users. And brand spending on social media advertising is rising.

One thing that 2018 did make clear, however, was that companies need diversify their social presence and have a well-thought-out social media strategy. Using data from Facebook, Instagram, Twitter, and LinkedIn, Fundera set out to discover which companies are driving the conversation on social media. We focused our report on social influence in the five fastest-growing industries.

You can read more about it here and check out the infographic below.

7—Understanding and Managing Business Credit

Capital One is helping demystify business credit for today’s business owners with the launch of Business CreditWise, an easy-to-use tool providing unlimited, free access to a company’s credit profile. Business CreditWise is available to any U.S. business (not just Capital One customers) and can be accessed at any time without impacting business credit.

According to a recent Capital One survey, 31% of small business owners have either never heard of business credit reports or know very little about them. By proactively managing their credit, businesses gain other important benefits such as better access to funding; becoming trusted partners, suppliers and vendors; and growing their businesses to capitalize on market opportunities.

“Business credit is a critical component of a company’s ability to secure financing, yet our research shows less than half of business owners have ever viewed their business credit reports,” says Jenn Garbach, head of brand and marketing for Small Business Card at Capital One. “Our goal is to empower businesses with products and tools that help them succeed and grow. With Business CreditWise, business owners can quickly and easily access their credit, correct mistakes and understand what is impacting their overall credit report, free of charge.”

Business CreditWise provides business owners with a free, in-depth view of their business credit reports, and includes:

- Unlimited access to your business credit report, sourced real-time from LexisNexisⓇ Risk Solutions, with no impact to your business credit

- A comprehensive view of key factors that impact business credit under four pillars: Business Details, Payments, Credit Usage and Public Records

- A guide to interpret your business credit report the same way lenders do with helpful, educational tips

- The ability to find and fix inaccuracies for free, with no hidden fees, by submitting disputes to LexisNexis Risk Solutions

8—Are PEOs Your Workplace Solution?

With record-low unemployment creating talent scarcity, increasing regulatory and compliance challenges, and a growing focus on workplace culture, SMB owners are facing critical workforce management challenges. At South by Southwest® (SXSW®) 2019, ADP TotalSource®, the largest certified Professional Employer Organization (PEO) in the United States, showcased how an enhanced PEO offering can help business leaders better address these challenges.

“As the needs of the workforce evolve, we recognized that our offerings must equally evolve to address the changing world of work,” says Brian Michaud, senior vice president of ADP TotalSource. “With constant updates to business regulations, changing global economies and advancements in technology, companies can benefit from having a partner in business growth. ADP TotalSource can provide valuable strategic guidance on current issues and trends including talent shortages and the growing emphasis on employer brand perception. Through these ever-evolving enhancements, we look forward to continuing to help our clients drive their overall business success.”

The full-service PEO offering gives SMBs real-time data insights and benchmarks, a blueprint to help clients unlock employee potential, investigation support for workplace issues such as harassment or discrimination, and a patent-pending approach to help businesses confidently select the right plan offerings for their employees and family members.

A PEO like ADP TotalSource allows a small or midsized company to offer the same services and benefits as those at a global enterprise, without the need to staff an enterprise-size HR department.

Offerings include:

- Working with SMBs to help them better engage and retain their workforce through solutions that support the core needs of an employee at work.

- A new patent-pending approach to help business owners target the best benefit plan offerings for their employees. Executives can compare plan options and make more educated decisions about what plan offering is best for their company and budget

- Receive access to built-in protection and expertise prepared to help you handle the most unexpected incidents. With the rise of discrimination and harassment claims, ADP TotalSource clients have access to a central investigation team to investigate complaints and provide guidance on a course of action.

- Access to data to identify trends, personalize recommendations and ensure the business continues to drive forward along with insights such as:

- Benchmarks to competition in areas such as turnover and overtime, staffing and understanding profit leaks

- Pay equity analysis to understand where potential gaps may exist

- Together with the client, ADP TotalSource develops a custom Success Plan that marries data analysis, the business’ current situation, and company goals that becomes the human capital plan for the organization

9—Bad Bosses

A new study by VitalSmarts, a top 20 leadership training company, shows the weaknesses of corporate managers across America. Researchers asked employees to disclose their boss’s significant weaknesses—ones that everyone knows and discusses covertly, but not directly with their managers.

According to respondents, the top 5 weaknesses bosses have but are unaware of include:

- Overwhelmed and inadequate (27%)

- A poor listener (24%)

- Biased and unfair (24%)

- Distant and disconnected (23%)

- Disorganized and forgetful (21%)

But why is feedback so one-sided? According to the study, the top five reasons people report for their office-wide silence of the boss’ bad behavior run the gamut. Specifically, they say:

- Speaking up would offend their manager (47%)

- Speaking up would cause their boss to retaliate (41%)

- They don’t know how to bring it up (41%)

- Speaking up would hurt their career (39%)

- The culture doesn’t support people who speak up (38%)

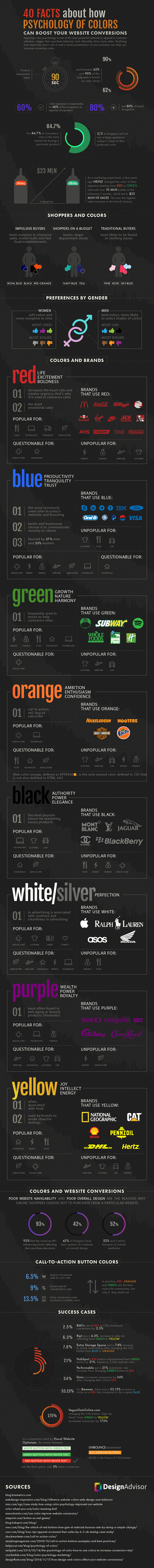

10—Color & Your Website

Color greatly influences how we organize, identify and interpret sensory information. And although our perception of color is mostly subjective, some of its effects are universal.

Recognizing the importance of color and its impact on behavior, marketers have long used the power of color in advertising and design. With the rise of the internet and the shift to online marketing and e-commerce, this reach has expanded to include web design.

Check out the ways color drive conversion rates in the infographic below from DesignAdvisor.

11—Working Capital for e-Commerce Companies

Payoneer, a leading payment platform, recently announced the expansion of its Capital Advance service, a unique working capital offering designed for e-commerce merchants. Capital Advance provides Payoneer customers the ability to receive working capital with the click of a button, giving them instant funds they can use to drive their businesses forward. New offers are extended regularly with repayment terms of up to 90 days for sellers on Amazon, Walmart, and Tophatter. This service expansion builds on Payoneer’s Early Payments product, launched in 2017.

Traditional financial institutions are typically not able to effectively underwrite e-commerce business models and as a result, e-commerce merchants looking to grow their businesses are often charged high rates or denied financing altogether. Payoneer’s Capital Advance service provides merchants the ability to receive funding quickly and easily, providing the capital they need, right when they need it. Payoneer’s Capital Advance service is not only instant, but low-cost and low-risk as it requires no collateral and the amount on offer is based on the merchant’s previous sales performance.

Cool Tools

12—LinkedIn Lead Gen Tool

Zopto Limited, a software development start-up based out of London, recently launched Zopto, an advanced cloud-based software tool that fully automates your LinkedIn outreach and lead generation efforts. The company targets SMBs and small digital agencies to use its platform as end clients or to partner to resell Zopto under their own brand.

Generating high-quality leads is a big challenge for B2B companies. Research shows 17% of marketers spend over 15 hours a week on lead generation and nearly 50% of them plan to increase their lead generation budgets.

Andrei Breaz, founder of Zopto says, “Zopto enables you to not only automate your lead generation process but also acquire customers outside of your network and enter new markets within days.”

Due to the combination of various engagement features, Zopto can also be used by startups to attract investors or even by recruiters to find potential candidates.

7 features:

- Open your Zopto account within minutes to start automating your LinkedIn outreach and generate sales leads and opportunities.

- Search and filter your ideal customers by using LinkedIn Premium or Sales Navigator and then select the level of engagement that you want to initiate.

- Enable relevant features like Connection Invites, Sequential Messaging, Free InMails, Twitter Engagement or Profile View Generator.

- Enjoy unlimited leads once Zopto campaign has started. You can then expect dozens or even hundreds of Hot leads per month, all generated on auto-pilot.

- Zopto’s unique Twitter auto favorite feature ensures that your profile gets an even greater visibility and exposure among your potential customers.

- Access to a live dashboard provides you with detailed information and statistics related to your LinkedIn lead generation campaigns.

- Get access to Email and Chat Support, one-on-one Strategy Calls and even a dedicated Account Manager depending on your pricing plan

Zopto offers a 5-day starter trial to evaluate the effectiveness of Zopto which includes 850 profile visits/day and the Twitter engagement feature. It also offers 3 different pricing plans for startups to established companies.

Click here to Get a Demo or learn How Zopto Works.

Small business stock photo by Dima Sidelnikov/Shutterstock